Gold $5000 Forecast for 2026 as Analysts Chase the Price Surge

GOLD and SILVER spiked lower on Thursday, briefly retreating from this week's record highs on surprise weakness in US inflation data and jobless benefit claims, while New York's S&P500 stock index rallied for the first time in 5 sessions.

With silver now rising almost 125% for the year as 2026 forecasts put gold at $5000 per ounce, platinum and palladium prices also dropped and rebounded, trading back towards new 17-year and 3-year highs respectively.

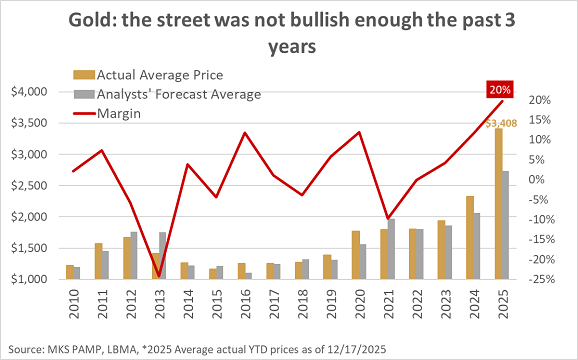

"2025 is collectively the largest underestimate/margin of error for all 4 metals in the LBMA's analyst polling history," says strategist Nicky Shiels at Swiss refiners and finance group MKS Pamp, pointing to the bullion industry's annual survey of professional market forecasts.

"No one saw these prices coming. That alone may lead to some overcompensation for 2026 estimates (ie, too bullish) when they are released in January."

With gold back above $4330 per Troy ounce on Thursday afternoon in London, "analysts at J.P.Morgan, Bank of America and consultancy Metals Focus now see bullion hitting $5,000 per troy ounce in 2026," says Reuters, highlighting "a growing investor pool and factors ranging from US policy to war in Ukraine."

Giant gold-backed ETF the SPDR Gold Trust (NYSEArca: GLD) expanded Wednesday but held 0.5% smaller than mid-October's 3.5-year record in tonnage terms.

As a whole, gold ETFs have this year seen the bullion needed to back their shares grow by the most since the pandemic year of 2020 according to data compiled by the mining industry's World Gold Council.

By value, that puts 2025 inflows 56.1% larger than 2020 at a record $77.3bn.

"Gold's resilience post-October's sell-off shows its appeal as a diversifier and safe haven endures," says Canadian bank BMO, forecasting that gold prices "could breach $4600/oz as soon as Q1."

"Here's Why We Don't Give Up on the Gold Trade" says a new note meantime from Canadian financial services group Scotiabank, which gave up trading and supplying gold in 2020 after failing to find a buyer for its once world-leading gold dealing business in 2018.

Today the "broad and synchronized" tailwinds which have driven this year's jump − the strongest ever outside 1979 for gold and silver − remain in place says the note from Scotia, which is now "planning to revive the metals trading desk" according to a report from Bloomberg, citing unnamed "people familiar" with the matter.

"The new desk will trade, lend and hedge raw materials including precious and base metals, with an initial focus on the former, the people added."

Should Scotia's comeback materialize following the revival of gold trading at Deutsche Bank and Mitsui, it will leave only UK bank Barclays as a major trader not to have returned to precious metals after quitting in the past decade.

Silver meantime spiked nearly $2 lower on Thursday's US CPI and jobless benefit claims data, but immediately rallied $1 per ounce to $65.70 − a new record high at the start of Asian trading yesterday.

Platinum also fell, dropping $90 from yesterday's 17-year high above $1980 per Troy ounce before rallying to show a gain for the week so far of 9.0% in Dollar terms as the US currency held above Tuesday's 2-month low on the FX market.

Sister metal palladium also dropped back today after reaching a fresh 3-year high near $1720, cutting its weekly jump to 12.9%.

"Platinum bar and coin investment demand in China is surging," says a new note from the mining industry's World Platinum Investment Council.

"Other developments in 2025 include the debut of platinum and palladium futures and options on the Guangzhou Futures Exchange, a gamechanger that has given domestic users of platinum a direct, regulated tool to hedge against price volatility."

Following last week's cut to US Fed interest rates, the European Central Bank today kept interest rates for the 20-nation Eurozone on hold as expected, while the Bank of England narrowly voted 5-4 to cut UK rates for the 4th time this year, split between concerns over a weak economy against stubborn inflation.

Gold priced in the Euro moved back above €3700 per ounce, up by 47.5% in 2025.

The UK gold price in Pounds per ounce also rebounded from the US data drop, trading at £3240 for a year-to-date gain of 55.5%.

Email us

Email us