No Christmas Break for Gold or Silver as Trading Hits New Record

...and 2026 starts even stronger still...

...while a surge in first-time buyers spurred record-heavy trading over Christmas and New Year.

Now 2026 has begun even more strongly.

Last month saw more people start buying precious metals than any December in BullionVault's 21-year history, rising 309.3% from the previous December.

That capped 2025 as our 3rd best year for new client acquisition worldwide, lagging 2020's Covid Crisis by 10.1% and the financial crisis' peak of 2011 by just 3.8%.

Already in 2026, this New Year has marked the strongest ever start to any month in BullionVault's history, matching last January's full-month total for new funded account openings in less than 6 days.

This record-strong New Year says that gold and silver are only gaining appeal as the White House continues ripping up the alliances and rules which Western investors thought they could rely on. Or maybe it just keeps the festive fun rolling after China's Christmas chaos spiked precious metals to new record highs.

Here at BullionVault, Christmas Week saw more than $148 million in precious metal change hands via our 24/7 website and smartphone apps, with trading volume on the 25th itself setting a Christmas Day record above $4m.

That festive record was followed on New Year's Day by trading volume in gold, silver, platinum and palladium hitting $6.5m − again, a day when the world's stock markets and retail bullion stores were shut, leaving investors unable to buy or sell precious metal ETFs, coins or small bars.

Across 2025 as a whole, trading volume on BullionVault set a new full-year record, beating the Covid Crisis record of 2020 by 16.8% in US Dollar terms at $3.1 billion. That reflects how precious metals, already the best performing asset class of the 21st century to date, blew past all other investments last year.

Overall, and including existing investors, the number of people buying gold across December rose 21.9% from November's 3-month low, while the precious metal's fresh record prices spurred a 34.5% jump in the number of sellers.

That saw the Global Gold Investor Index, a unique measure of private behaviour in physical bullion, rise 0.4 points to 55.1, its highest December reading since the Covid lockdowns of 2020 (57.0).

Any reading above 50.0 signals more net buyers than net sellers across the month. The Gold Investor Index set a series low of 47.7 in March 2024 and a post-Covid peak of 57.9 this October.

And while existing investors continue to take a little money off the table as gold runs to fresh record highs, the pace of profit-taking remains very measured. That signals long-term confidence in gold as a hedge against uncertainty and risk.

By weight, gold's festive price spike saw BullionVault users as a group cut their gold holdings by just over one-third of a tonne, taking net liquidation across 2025's run of new record prices to half-a-tonne, down 1.3% from 2024 to finish the year with total holdings of 43.5 tonnes.

But by value, and held in high-security vaults in each client's choice of London, New York, Singapore, Toronto or (most popular) Zurich, BullionVault customers' gold leapt by 62.8% last year to a record $6.0 billion.

Silver's dramatic spike to new record prices also spurred profit-taking by weight in December, with net selling of a little more than 1.5 tonnes taking total outflows across 2025 to just over 4 tonnes.

That cut client silver holdings 0.4% by weight from the end of 2024, slipping to 1,152 tonnes. Yet by value, that private stockpile of the industrially-useful precious metal leapt 143.4% in 2025 to a record of more than $2.6bn.

Including existing investors, December saw a record number of people buy silver on BullionVault, leaping 132.3% from November's 3-month low.

The number of silver sellers also hit a new all-time high, rising 44.5% and greater by 1/10th from the previous record set in October.

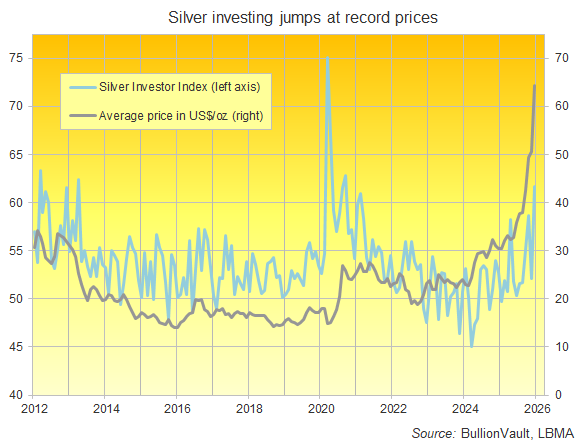

Together that sent the Silver Investor Index 9.6 points higher at 61.7, the strongest monthly reading since September 2020 with the steepest jump since that March's Covid Crash in industrial commodities spurred heavy bargain hunting.

You can see how silver has really grabbed investors' attention, leaping to new record prices and delivering strong out-performance over gold. And while 2026 should struggle to repeat last year's stellar gains in precious metals, the forces driving gold and silver higher remain very much in place.

Email us

Email us