Return of the Kitty

A short history of meme squeezes...

JUST when you thought trading couldn't get any crazier, meme stocks have suddenly reappeared – along with some of the more prominent speculators from the Covid Bubble era, writes Greg Guenther in Addison Wiggin's Daily Reckoning.

"Roaring Kitty" – the infamous trader who made a killing by starting the grassroots short-squeeze movement that gave birth to some of the wildest runs in stock market history – suddenly reappeared on Twitter/X late Sunday following a three-year hiatus to spark another run in his beloved GameStop Corp. (GME).

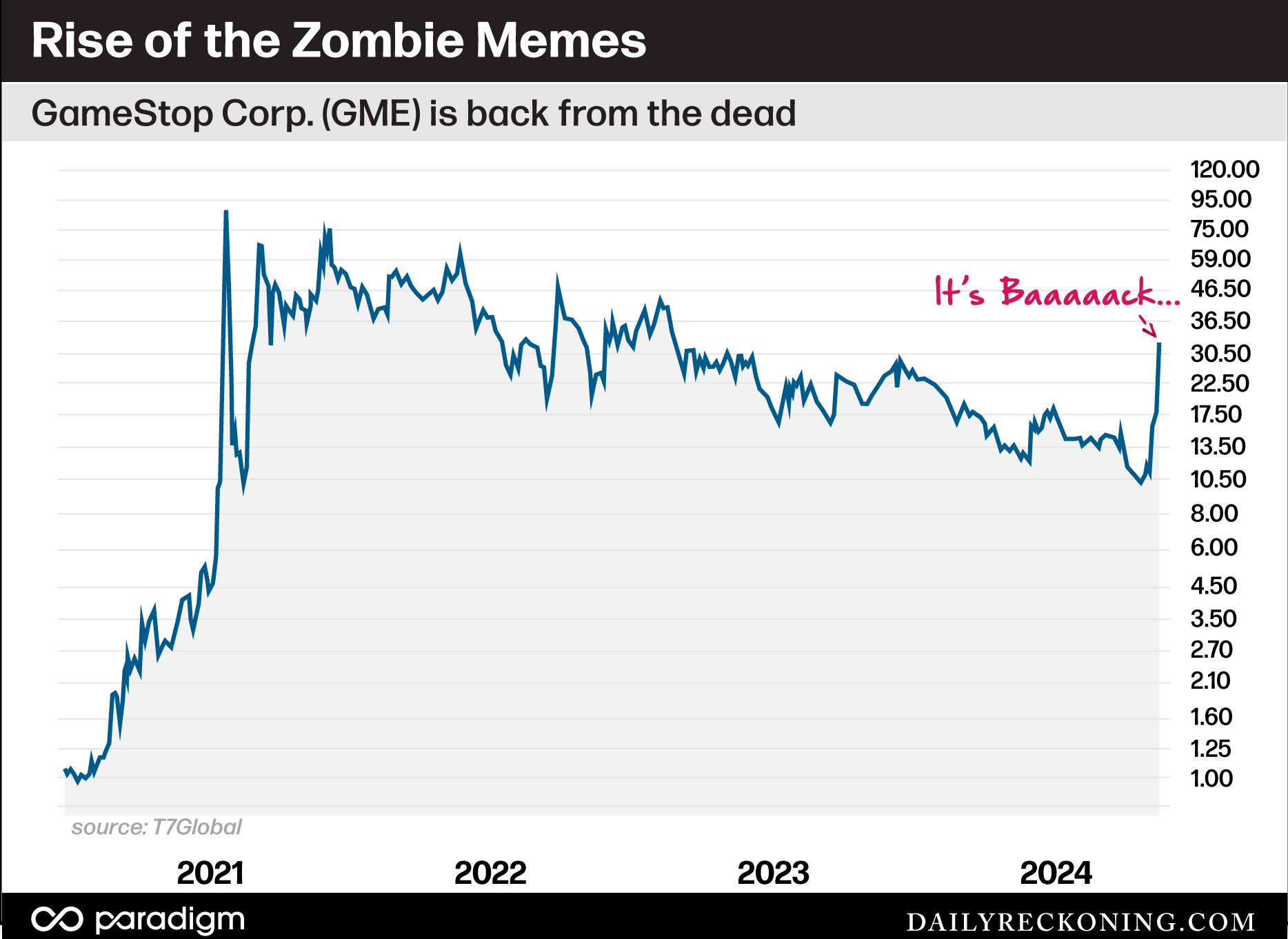

GME exploded higher in 24-hour trading on Robinhood late Sunday evening. The stock then promptly doubled Monday morning before getting hit with a mid-morning volatility halt. When the dust finally settled, GME closed with a gain of 75% on the day.

The Kitty didn't post anything of substance to spark this furious rally – just a quick meme that made no mention of GME by name. But anyone who was even remotely in tune with the underbelly of the meme market knew exactly what he meant.

For starters, GME shares were already on the move last week. The stock jumped 70% in just three trading days leading up to this week's explosive move. The fuse was lit – and Roaring Kitty pounced, inspiring an army of speculators to follow his lead.

I opted for a longer-term view on this chart going back to 2020 to help put this recent rally into context. You can clearly see the huge move that catapulted GME into early 2021 on the left edge of the chart. While we've seen some echo rallies since the roaring Covid Bubble, nothing has come close to that epic run more than three years ago. Until now.

Is this the beginning of another outrageous meme stock rally?

If so, can a sober trader actually make money on these stocks...without losing his mind?

Before we attempt to answer these questions, let's take a look at what happened to these stocks after the squeeze was over.

Months after the echo rallies faded into oblivion, the formerly unstoppable meme stocks that captured the market's imagination faded back into obscurity. And late last summer, we finally put them to bed.

The army of ragtag names was two years removed from its brief era of market domination – and most of the names were nearly unrecognizable from the early days of 2021.

AMC Entertainment Holdings (AMC) resided at the bottom of the pile, down a cool 99% from its 2021 highs (a couple of reverse splits kept the stock afloat and listed in August 2023).

Of course, AMC wasn't the only garbage stock to parlay its pandemic fame into a couple more years of reverse splits and common stock offerings. GameStop (GME) and Bed Bath & Beyond rounded out the ranks of the more popular trading names. And let's not forget the pandemic round-trippers. Zoom Video Communications (ZM), Peloton Interactive Inc. (PTON), and others experienced a brief yet powerful boom-bust cycle.

But there was a distinct lack of hype during the late summer doldrums last year. At the time, I was able to dig up some stray articles on how AMC raised hundreds of millions of Dollars issuing stock to the deluded masses of online stock gamblers. Other than that, there was no media coverage at all – and this was a stock that was on the news every single day in early 2021.

In the early days of the raging pandemic bull market, you couldn't escape these ridiculous meme stocks – and the throngs of speculators who believed they were somehow sticking it to the man by temporarily bullying the shares of a failing movie theater.

But two short years later? Crickets...

The meme stock revolution hit the market with a bang, we noted. And it died with a whimper.

No one was buying these stocks. No one wanted to talk about them. There was a time when these trades couldn't lose. But in late 2023, it seemed as though no one could remember what all the fuss was about in the first place.

The biggest, wildest speculations of the early part of the decade were no longer delivering the insane gains everyone expected.

Traders cashed in what's left of their chips and went home. At the time, I assumed they wouldn't be back anytime soon. Yet here we are less than a year later, watching the familiar story beginning to emerge...

Is it really happening all over again?

It can be nearly impossible to maintain sanity and objectivity as these short squeezes unfold.

Some investors become downright angry as these speculative bubbles develop, mainly because the extreme price action tends to reward bad behavior. Imagine practicing sound trading techniques for years, only to watch some kid with a Robinhood account book a six-figure gain YOLO-ing out-of-the-money weeklies.

It's enough to drive a trader completely nuts.

Unfortunately, most of these speculators won't keep the money they make on these trades. They'll plow the winnings into another long shot. And eventually, the market will even the score.

One of the main mistakes I see when I venture onto the message boards is inexperienced traders putting way too much money into a single play – almost as a "get rich or go broke trying" strategy.

But when you're dealing with these extreme stock moves, you don't have to risk a ton of capital to get involved and put up some impressive gains. Why bet the farm on what amounts to a spin of the roulette wheel?

I'm not sure that any "advice" like this is useful when it comes to meme trades. But if you are going to venture into these shark-infested waters, try not to get sucked into the hype. These are not long-term investments. Don't sweat perfect entries. Take what you can get with tiny positions.

And pack your bags early. When that last plane takes off, you don't want to be left standing on the runway.

Email us

Email us