Jerome 1, Windmill 0

Inflation now a past-tense thing for the Fed...

The FED CHIEF is now talking about inflation in the past tense, says Gary Tanashian in his Notes from the Rabbit Hole.

"This inflation WAS not the classic demand overload, pot-boiling over kind of inflation that we think about. It WAS a combination of very strong demand, without question, and unusual supply-side restrictions, both on the goods side but also on the labor side, because we had a [labor force] participation shock,"

Demand created by pent up pandemic lockdown refugees finally released into the Consumer-sphere with their newly printed (inflated) Dollars in hand. Regardless, the Quixote-like Fed has finally stopped tilting at the inflationary windmill.

Jerome Powell is speaking as if a conquering hero. Jerome 1, Windmill 0.

One year ago NFTRH was forecasting this moment with a view of a disinflationary Goldilocks rally environment to be led by Tech, born out of a combination of the mid-term election cycle, wildly over-bearish sentiment at the time and of course, Fed relief due to disinflation.

We. Are. There.

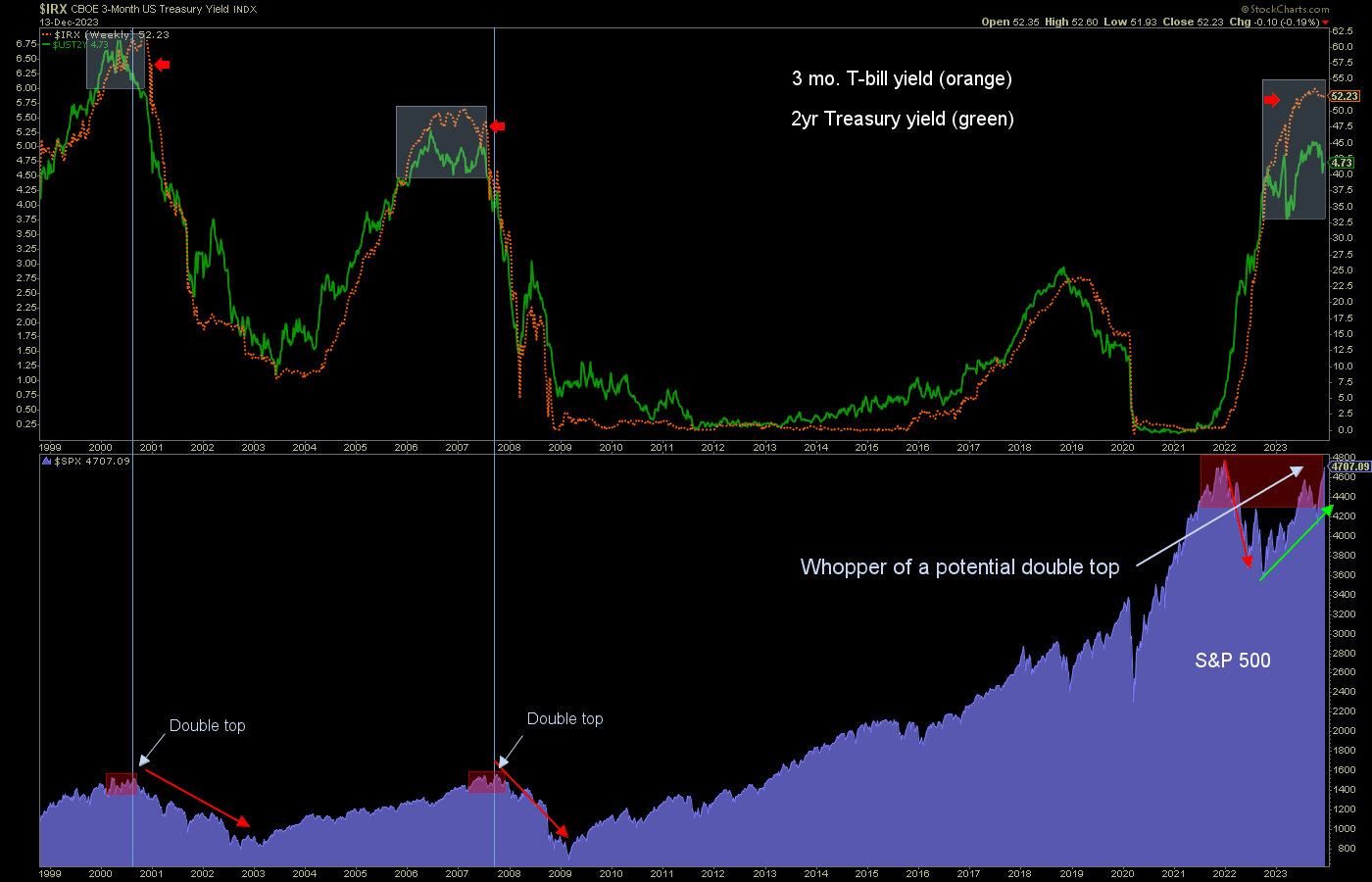

But now it is up to animal spirits to finish painting this compelling picture of a bearish market signal juxtaposed against a euphoric bullish stock market. Said spirits would theoretically drive SPX to its double top (already there) with an expected throw over to new all-time highs for good measure.

This is all according to the primary plan NFTRH has been working to since Q4, 2022.

The play has gone on much longer than originally anticipated (I had it as a Q1, 2023 rally and then into Q2), but here we are a year later with full bull engaging and looking for a new high. So be it. We don't make predictions. We make projections and adjustments along the way. But the primary view was right and today it is still right.

That view was and still is for growing optimism amid the fade of the evil known as inflation.

Speaking of optimism, the market had what I've termed a "bull killer" reading last summer. Then came a correction and now comes bull killer #2.

How can the bull be killed twice? Work with me here.

It's a sentiment extreme, not a timer. It is a condition to a coming top. Moreover, note the wonderful symmetry of the green and red arrows. There was an original bull birther before the market actually bottomed in Q4, 2022 and today there is another killer before the market actually tops, likely in 2024.

Meanwhile, gold, silver and the miners are expected to be star players in this rally, despite the Goldilocks backdrop, because the rally is coming amid a pivot period from hawkish to dovish by our monetary-regulating overlords as Jerome Hawkeye Powell publicly flips, with words about inflation in the past tense.

But there is a part 2 to this story and it will play out in 2024, either sooner or later, to the implication of the bond signal/SPX chart above. A bearish implication. But for today, it is the holiday season, the anti-market (USD) is dropping like a stone with the withdrawal of hawkish policy...

And well, Wayne? Garth?

Frankly, after a moderately successful but grinding year I am going to fully enjoy coming market events. Both as a casino patron now and as a dead eyed market manager later, as risk climbs, herds assemble and cement their perceptions, and the whole noisy cacophony careens toward climax.

Later in 2024 there will be an opportunity to trade bearish with conviction and to hold precious metals with conviction as well. It's a post-bubble thing...

...the "bubble" being not stock markets but rather the 20+ year uninterrupted run of monetary policy bubble making that has fed what many call a stock market bubble.

Email us

Email us