Easy Money, Rotten Economy

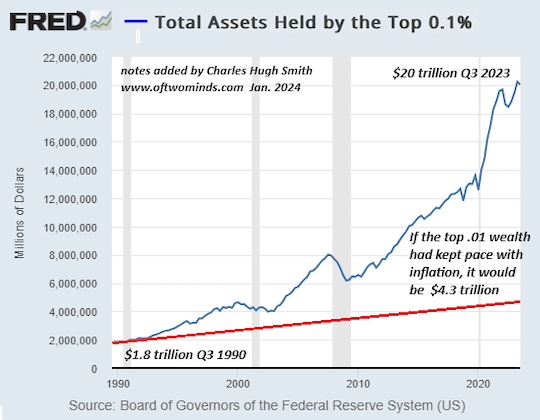

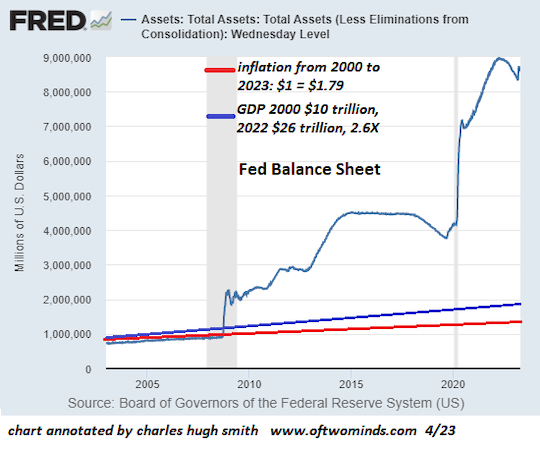

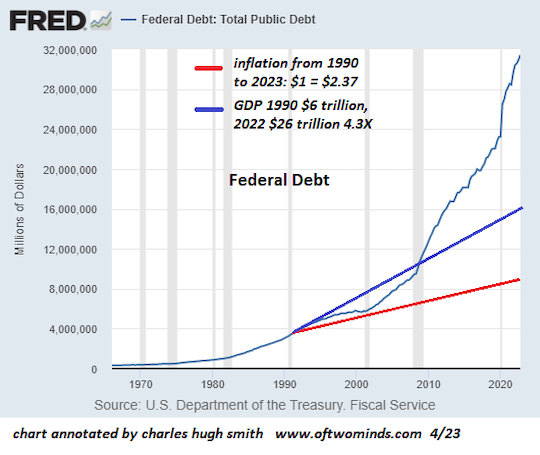

- Do the math: The limits of the real world cannot be dissolved by trickery, and...

- The core systems of the status quo are obsolete. They are being defended not because they work but because those being enriched by the systems want to maintain their power and perquisites.

Email us

Email us