Why Do the Heaviest Borrowers Dominate Bond Funds?

Bigger the borrower, bigger the weighting...

BOND FUND managers may soon become the definitive and doleful examplar of economic agents, with all the attendant risks for their investors, writes Tim Price of Price Value Partners.

It's unlikely, for example, that your typical bond fund manager has much, if any, of his personal wealth tied up in his fund. By dint of being price-insensitive, he will manage his fund not in the best interests of capital preservation for his investors, but with the highest likelihood of matching or outperforming his benchmark.

Unfortunately for his investors, his benchmark isn't fit for purpose. Like most equity benchmarks, it is a function of market size, as opposed to quality. In other words, the institutional bond fund world legitimises sovereign borrowers with specific reference to their level of indebtedness: the more indebted the country, the larger the capitalisation of its bond market, and therefore the more significant that country is within the bond market universe.

The largest components within the global bond benchmarks are the most heavily indebted issuers – be they countries or companies. All things equal, the most heavily indebted issuers are most likely to be debtors, not creditors. But if you want to lend your money to somebody (which is what buying their bonds amounts to), it only makes sense to lend your money to someone who is capable of paying you back.

Bond benchmarking forces bond fund managers to allocate their investors' capital to some of the very worst credit risks. Bond fund managers pursuing inappropriate benchmarks are pouring money into increasingly expensive sovereign bond markets that at some point will trigger huge losses for their investors as interest rates rise beyond the capacity of issuing governments to service their debts. Bond fund managers are not risking their own capital, so they will continue to try and meet the narrow demands of their institutional mandates.

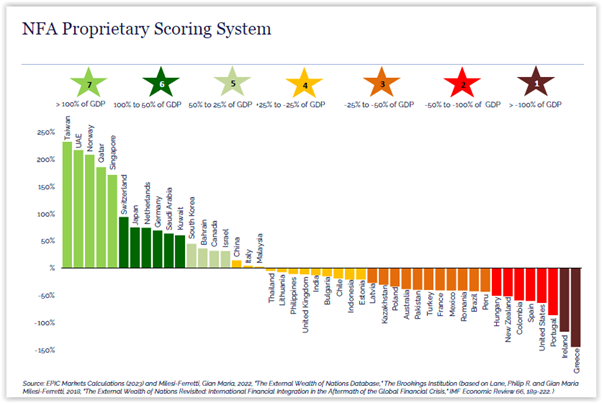

On any rational analysis, this is an absurd state of affairs. Beyond a certain point, which even the dubiously creditworthy US may now have reached (see Chart 1 below), a vastly indebted country can enjoy a formal AAA or AA credit rating, and sit proudly atop an index ranking bond market size, and yet represent a significant risk to (private) investors' capital. If there were ever a time to be concerned about the prospect of capital loss in G7 government bond markets – whether via serious price degradation consistent with rising market interest rates or, ultimately, via terminal default or inflationary repudiation – now is that time.

The debt to GDP metric as an assessment of sovereign bond quality is not appropriate. A far superior way of assessing sovereign creditworthiness is to use a metric known as net foreign assets to GDP.

For any country with control over its printing press, servicing debt obligations issued in its domestic currency is easy: in extremis, if it experiences a shortfall between revenues and expenditures, it can simply print more money in order to make those interest or principal repayments.

But whenever countries get into difficulty (by over-borrowing) in the bond markets, it is invariably the foreign borrowings that cause the problems. Take the UK.

His Majesty's Government will never have any trouble servicing its sterling denominated debts – the government can effectively print more money, indefinitely, to pay them. But the UK government has also borrowed money in foreign currencies, such as the US Dollar. The UK government cannot legally print US Dollars, so it's critically important that the UK maintains foreign assets as well as purely domestic (sterling denominated) ones whereby it can service its debts. Which is where the net foreign assets metric is useful.

Net foreign assets comprise the totality of government sector, corporate sector and household assets. A country with surplus net foreign assets is a genuine creditor country. A country with only net foreign liabilities is a debtor. Chart I shows, as at 2023, where various countries sat on the spectrum of net foreign assets to GDP.

The countries on the left of the chart – the likes of the UAE, Norway, Qatar and Singapore – are all objectively wealthy.

They are creditor countries with meaningful surplus foreign assets. They are highly unlikely to default. Their bonds are objectively creditworthy. The same cannot be said for the countries on the right hand side of the chart. They are debtor countries without any meaningful foreign assets – only liabilities. In extremis, they run the risk of default. Indeed some of them already have.

We can even treat this chart as something like a prospective road map for future sovereign defaults. Looking at the worst culprits (those countries furthest to the right on the chart), previous ultra-low scorers like Iceland have already defaulted. Who might be next? Using the net foreign assets metric as a guide, and assuming that the EU somehow manages to bail out (more likely bail in) the afflicted, it could be, erm, the United States itself.

Endgame?

As anyone who has ever worked in a bond dealing room can testify, the bond market is ordinarily an oasis of sobriety compared to the manic meanderings of equities. Not for the bond salesman the hot tip or the alluring nugget of inside information of dubious provenance. The bond market is powered by a coolly dispassionate macro engine. It is driven by rational analysis of currencies, interest rates and inflation.

Unlike a giddy and easily rattled stock market, a sober and reasoned bond market can also exert powerful leverage over politicians. As US Democrat adviser James Carville once said: "I used to think if there was reincarnation, I wanted to come back as the president or the Pope or a .400 baseball hitter...but now I want to come back as the bond market.

"You can intimidate everybody."

And for the past 40 years and more, until very recently, the bond market's trajectory has been: effortlessly higher. Bond prices have soared; their yields have collapsed. US long bond yields, which stood at 15% in 1981, have been grinding relentlessly lower, as a combination of central bank policy and benign trends in globalisation that have succeeded in bewitching the gods of inflation. Perhaps most notoriously, Japanese government bond yields fell all the way from 8% in the early 1990s to below 0%, as a genuine deflation and a banking and property crisis worked their magic on bond prices.

Where, asks the bond market agnostic, is the influence of supply and demand upon bond prices? This is a good question, and more than usually pertinent given that we may be at something of an inflection point in the evolution of the market. In a remarkable confluence of events that looks almost like conspiracy to the outsider, G7 bond prices rallied over the course of more than two decades even as the supply of those same government bonds shot through the roof. A combination of rising prices and rising supply looks a little too much like financial alchemy.

What makes the near-term outlook so exquisitely uncertain is that bond markets and stock markets do not trade in isolation. At a time of heightened (equity) market volatility, what would under normal market conditions constitute a waltz of mutual interest between stocks and bonds disintegrates into a cold war stand-off of mutual distrust, with each market trading off and anticipating weakness or recovery in the other. This sort of nervous reflexivity makes for lousy longer-term asset price forecasting.

Further global tightening of monetary policy must occur at some point. It will impose an inevitable drag on the performance of risk assets. Ongoing repositioning and risk reduction from sometimes leveraged financial institutions will exacerbate the amplitude of market declines.

Albert Edwards of SocGen deserves some credit for maintaining his Ice Age thesis over a sustained period of widespread scepticism from other market participants. He summarises it as follows:

"First, that the West would drift ever closer to outright deflation, following Japan's template a decade earlier. And second, financial markets would adjust in the same way as in Japan. Government bonds would re-rate in absolute and relative terms compared to equities, which would also de-rate in absolute terms.

"Another associated element of the Ice Age we also saw in Japan is that with each cyclical upturn, equity investors have assumed with child-like innocence that central banks have somehow 'fixed' the problem and we were back in a self-sustaining recovery. These hopes would only be crushed as the next cyclical downturn took inflation, bond yields and equity valuations to new destructive lows. In the Ice Age, hope is the biggest enemy.

"Investors are beginning to see how impotent the Fed and ECB's efforts are to prevent deflation. And as the scales lift from their eyes, equity, credit and other risk assets trading at extraordinarily high valuations will take their next Ice Age stride towards the final denouement."

Several high-profile reports have recently been published drawing attention to the debt problems gnawing away at the economic vitality of the West. Perhaps the most damning response to date came from the Euro zone's all-time pre-eminent political cynic, Jean-Claude Juncker:

"We all know what to do, we just don't know how to get re-elected after we've done it."

This may be the most dangerous market environment in history. Investors have placed a lot of faith in the ability of central banks to avoid disaster – to suppress market interest rates and bond yields, and to support equity prices. But as the Swiss National Bank showed in January 2015 when it removed the Swiss Franc's peg to the Euro, central banks cannot always be trusted. Investors – both in stocks and in bonds – are effectively playing chicken with the central banks, surfing a tidal wave of liquidity on the expectation that this liquidity, an ocean of easy money, will never drain away. Who will blink first: markets or central banks?

The financial markets are awkwardly polarised between fears of profound debt deflation and fears of uncomfortable monetary inflation. On the basis that generals are invariably transfixed by the last war, it might be fair to suggest that Americans are determined never again to experience the debt deflation of the 1930s. Given the role and extent of government indebtedness throughout the modern world, a debt deflation is a practically unthinkable outcome. But just because something is deeply undesirable does not make it impossible. In their eagerness to pump money into the system to make up for the credit contraction caused by an ailing banking system, the politicians of today may be setting themselves up for the last financial war painfully recalled by German monetary officials, namely the Weimar hyperinflation.

If officials don't deliberately design or ignite an inflation, it may come about in any case via the foreign exchange markets, or a surge in government bond yields. As Jens Parsson indicates in his study Dying of Money:

"The spectre that waits in the wings of any inflation, including the American, is the general exodus of the people from the currency when they lose faith in it at last. When this spectre steps in from the wings, the government's games are over and the final curtain is not far away."

The practical response to overvaluation in the bond market?

If you do not need to own bonds, then don't. And if you are obligated to hold bond investments for some reason, then focus solely on high-quality bonds issued by creditor countries or issuers as opposed to debtors.

Central banks may have succeeded in supporting bond prices, and suppressing bond yields, by way of outrageous price manipulation, but history suggests they will not be able to do so forever. At some point, the market will have its say. Its response is likely to be unprintable for the holders of most forms of government debt.

In the meantime, superior investment choices exist. Investors requiring any combination of income and capital growth will almost certainly be better off purchasing the shares of high-quality businesses at fair valuations instead. We see especial merit in the shares of commodity companies at fair valuations – which most of them now possess. Within that market we see especial merit in the shares of profitable gold and silver miners, because at some point a debt disaster now seems possible – the sort of disaster which could even afflict the monstrously indebted US government.

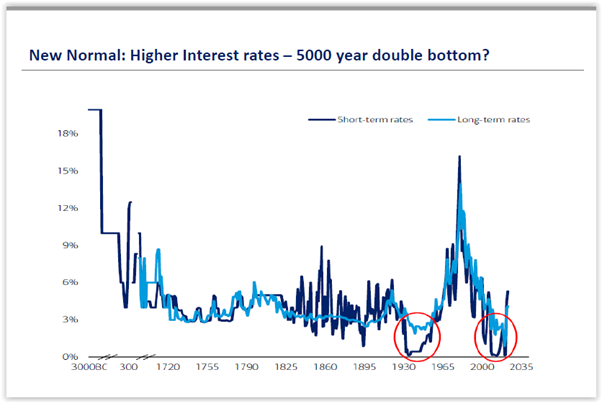

Chart 2, courtesy of the Bank of England, shows just how low both short and long-term interest rates are, covering a period of 5000 years.

(For data prior to the 18th century, the Bank has used interest rates reflecting the country with the lowest interest rate reported for various types of credit. From 3,000 BC to the 6th century BC these rates come from the Babylonian Empire. From the 6th century BC to the 2nd century BC they come from Greece. From the 2nd century BC to the 5th century AD they are drawn from the Roman Empire. Subsequent data come from regions including the Netherlands and Italy.)

And those rates haven't realistically been lower in 5,000 years. For anyone alive during that 1970s inflationary spike in interest rates, the interest rate game has clearly changed profoundly within their own lifetimes. An observation in passing: during the 2000-2011 commodity rally, the price of gold went up by 7 times. During the 1970s, the price of gold went up by 20 times. Is today's environment comparable to that of the 1970s? In debt terms alone, it is objectively worse.

Although the timing is not clear, at some point interest rates, we think, must rise further – unless our central banks can keep them artificially suppressed indefinitely. In the event that interest rates rise from current levels – and in a somewhat uncontrolled, involuntary way – the damage to bond markets (and fiat currencies) could be spectacular.

Got gold?

Email us

Email us