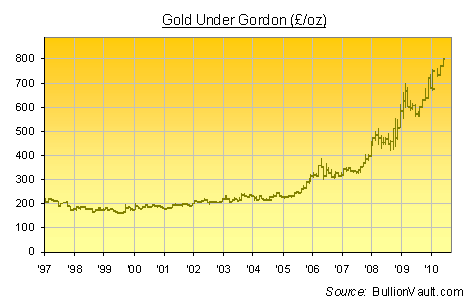

Gold's £800 Goodbye to Gordon Brown

Britain goes to the polls...and gold says "Goodbye" in fine style to Gordon...

HOW SWEET of gold to mark Gordon Brown's last day in power with a new all-time high against the Pound Sterling. He did so much, short term, to dent the former. But his famous "prudence" – in truth, an abject misreading of both economics and history – has in fact worked to destroy the latter instead.

He did so much, short term, to dent the former. But his famous "prudence" – in truth, an abject misreading of both economics and history – has in fact worked to destroy the latter instead.

Perhaps today's valedictory jump...leaping 3.7% to touch £805 an ounce...was just one last blow-off to mark Brown's political passing. But the Gold Price in Sterling looks more ironic than toppish given his legacy of debt.

The man who sold over 55% of the UK's reserves 11 years ago – advising the market two months in advance so it could get itself short...and in fact lending out one-fifth of the UK's total reserves* so gold-sellers could do precisely that, as well – Gordon Brown had come to power with gold trading around £200 per ounce.

But rather than leaving gold prices lower...as his ill-advised sales (well, Goldman Sachs-advised, in fact) did at first...the Irn-Bru chancellor has instead given long-term British gold buyers 23% gains for every year of his prudence.

Cheers, Gordon! We might (grow to) miss your smile. Thanks to your fiscal incontinence, however, it should be a few years yet before we miss your impact on gold.

Ready to Buy Gold...?

* Note: Ahead of Brown's May 1999 announcement, the Treasury's Exchange Equalisation Account had up to 23% of its 715-tonne stockpile out on loan, according to official data. That gave short-sellers the gold they needed to borrow, so they could sell it, and then it buy back lower down...returning it to the government's vaults after pocketing a fat wad as difference.

In fact, by the time that gold prices in Sterling finally broke back to five-year highs above £200 an ounce, the UK government had facilitated more shorting of gold than it had actually sold itself into the market.

Email us

Email us