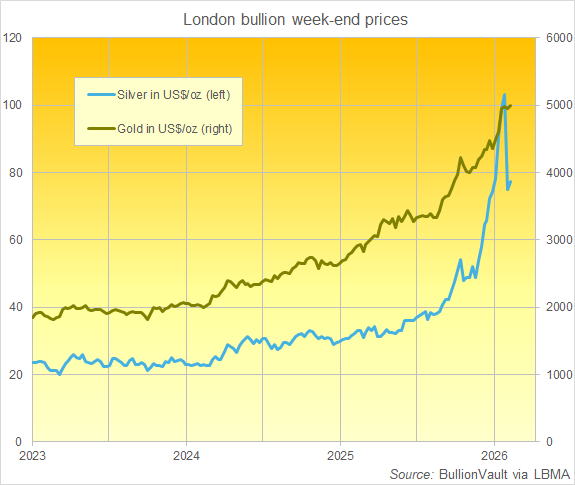

Silver Leaps on Inflation Data, Gold Sets New Week-End Record as China Trading Shuts for New Year

SILVER LEAPT and gold made a record-high weekly close in London on Friday after trading in Shanghai's "unruly" market closed for the Chinese New Year holidays and a dip in US inflation data boosted hopes for interest-rate cuts by the Federal Reserve.

The cost of living rose 2.5% per year in January on the 'core' CPI measure, matching consensus forecasts, while the headline rate − which includes fuel and food − slowed sharply to 2.4%.

But so-called "supercore" inflation jumped at the fastest monthly pace since last January, leaping to 7.3% annualized when housing costs are stripped out.

Silver leapt by $2 per Troy ounce having already fixed above $77 at London's midday auction.

Gold then failed to complete a week of 3pm benchmarks above $5000 − repeating its 4-session run of the last week of January, only without that Friday's dramatic gold price crash − but fixed with a new record high week-end price barely $2 shy of that level.

With China's financial markets now shut until a week-on-Monday to mark the new Year of the Horse, local and national authorities in the southern megacity of Shenzhen today clamped down on unregulated speculation in precious metals following the failure of 2 trading platforms amid late-January's dramatic price action.

Warning promoters not to use slogans like "Get rich by buying gold", ten government departments including the local branch of the People's Bank have now banned dealers from making pre-priced, leveraged or deferred transactions of the kind sold to retail investors by JWR and Ydd007.

"Regulators intervene to contain fallout after volatility in global prices sparks market turmoil at home," says the South China Morning Post.

But US Treasury Secretary Scott Bessent last weekend put it the other way around, saying of the historic surge and crash that "things have gotten a little unruly in China...[so] they're having to tighten margin requirements" in regulated Shanghai trading contracts.

"Investment demand for gold ETFs from China/Asia has emerged as a critical driver of gold prices over the past few months," adds Canadian advisory BCA Research.

That could risk "a meaningful price drawdown in the near term" BCA says, because the surge in Asian gold ETF inflows looks "very momentum-driven."

Open-interest in US Comex precious metals contracts is meantime relatively low despite these elevated prices, notes strategist Nicky Shiels at Swiss bullion refiners and finance group MKS Pamp.

That makes "another finger / metric pointing toward Asian demand and the ramp up ETF product success in India and China, albeit off a low base.

Today's US inflation data left the Dollar little moved on the FX market, rallying from end-January's 4-low versus other rich-economy currencies but holding close to its weakest Chinese Yuan FX rate since May 2023,

With US President Trump naming Kevin Warsh as his choice to replace Jerome Powell as chairman of the Fed, "I think by the time we get to the end of the year, it's going to be substantially more than two cuts" to interest rates says long-time gold bull, fund manager David Einhorn of Greenlight Capital.

Whilst dramatic, Friday's rally in gold and silver failed to erase yesterday's precious metals slump on surprise US jobs data, with the 'safe haven' creeping back above $5000 in spot trade as London closed while the more industrially-useful metal cut its gains back to $78 per Troy ounce.

Email us

Email us