Gold and Silver Slip as Comex Bulls Retreat, China Trading Shuts for New Year

GOLD and SILVER PRICES slipped on Monday as No.1 precious metals consumer China stayed closed for this week's Lunar New Year celebrations while US stock and bond markets were shut for the Presidents' Day holiday, writes Atsuko Whitehouse at BullionVault.

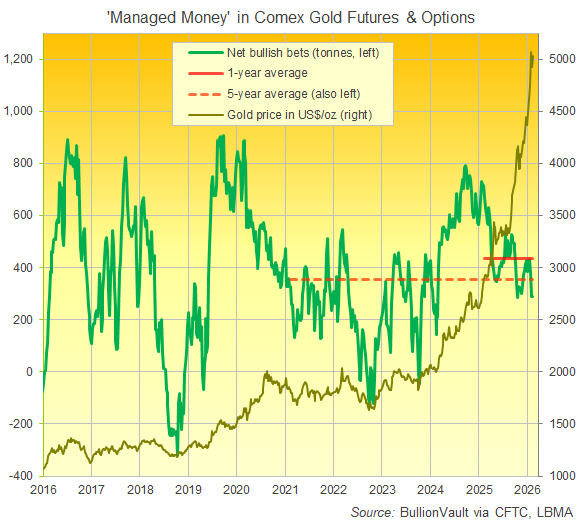

Latest Comex derivatives data show speculative positioning in US gold futures and options continuing to moderate from January's extremes, even as gold prices hold close to this New Year's record highs.

Spot gold prices in London fell as much as 1.5% to $4967 per Troy ounce Monday morning, before paring half those losses by lunchtime.

The dip came after gold made a record-high weekly close at London's afternoon benchmarking auction following a dip in US inflation data, boosting hopes for interest-rate cuts by the Federal Reserve.

But in the 5 trading sessions ending last Tuesday, latest data show that hedge funds and other leveraged speculators in Comex gold futures and options had cut their net bullish betting on gold as a group for the third week running, reducing their position as a group to a three-month low at a notional weight of 289 tonnes.

That was 33.3% below the Managed Money's one-year average net speculative position and 18.3% below the five-year average.

"China − a key engine behind the month-long rally in precious metals and selected industrial metals − will remain closed through 23 February, potentially limiting additional upside in the near term," says Ole Hansen, commodity strategist at derivatives platform Saxo Bank.

Gold futures trading on the Shanghai Futures Exchange − already booming over the past 3 years − rose 17% month-on-month as prices leapt in January, reaching a level 72% above the five-year average according to the mining industry's World Gold Council.

Both the SHFE and the Shanghai Gold Exchange have repeatedly tightened trading conditions for gold and silver contracts by raising margin requirements and daily price limits − particularly around late-December, late-January, and early-February's holiday risk-control periods − with margins increasing to as much as 22% at the futures exchange and 27% on the physical wholesale market, part of what the authorities call alongside temporary risk-control measures.

The volume of gold trading on the Shanghai Gold Exchange (SGE) last week fell to a 5-month low, while trading volumes on the Shanghai Futures Exchange (SHFE) fell to the lowest week-average since mid-January.

Comex volumes in gold futures and options also fell last week, down to the lowest level since August 2025 after the CME repeatedly raised trading requirements on US metal derivatives contracts − most especially gold and silver − and switched to a percentage-based margin system, significantly increasing collateral demands to curb volatility and "reduce systemic risk" since December 2025.

While latest data say Comex speculators cut their net long position in gold by size last week, its value rose 1.8% to $46 billion − still markedly below the record $66 billion hit in the week-ending 20 January − after falling to the lowest since end-November.

Like SHFE trading volumes, Chinese gold ETFs also expanded in January, recording their second strongest month ever with a fifth consecutive monthly inflow of investment money.

Those inflows, plus higher gold prices, pushed the total value of assets under management up 38.0% from end-December to an all-time high AUM of RMB333 billion (US$36 billion).

Among Western gold-backed ETF investment trusts, the giant GLD last Friday held little changed at its smallest size since mid-January, while No.2 gold ETF the IAU held unchanged at a 2-week low by the number of shares in issue.

Giant silver-backed ETF the SLV shrank last session to its smallest since the end of January, when the price of silver made an 'unprecedented' crash.

Today's spot price of silver, which now derives nearly 60% of its annual demand from industrial uses, fell as much as 3.4% to $74.74 before paring almost all of those losses by Monday lunchtime in London.

Speculators in Comex silver futures and options raised their net bullish betting on silver by 2.1% to a notional weight of 713 tonnes in the week-ending Tuesday 10 February according to the latest positioning data published by US regulator the Commodities Futures Trading Commission (CFTC).

That was still 85.1% below the Managed Money's 1-year average and 78.6% below the five-year average.

On a value basis, those net bullish positions fell 6.2% week-on-week to $1.8 billion, the lowest level since 27 February 2024.

The Managed Money's net speculative position had reached $8.3 billion on 23 December, the highest since the $8.9bn seen just before the 2024 US presidential election.

The all-time high remains $9.6 billion from start-August 2016, amid the aftermath of the UK's shock Brexit referendum on leaving the European Union.

"The silver market is still showing tightness in China, with futures in Shanghai being in backwardation," says German refining group Heraeus in the latest note.

"There are, however, tentative indications that speculative intensity is moderating, with SHFE open interest declining as investors reduce exposure into the holiday period as the Chinese New Year begins."

Email us

Email us