Silver Most Volatile in 40 Years as Gold Volatility Eases from Lehmans' Level

VOLATILITY in GOLD and SILVER steadied on Tuesday after surging to multi-year highs, with prices turning less volatile after reversing one-half and 1/4 of last week's historic price crashes respectively.

Moving less than $70 high-to-low today above $5000 per Troy ounce, the price of gold traded in its tightest week-day range since Monday 19 January.

Silver meantime moved $2.40 high to low above $80 per ounce, trading in its tightest Dollar range since Christmas Day but still swinging by well over twice its average daily move of the past 12 months.

On a 1-month annualized basis, volatility in the US Dollar price of gold has now hit 54.8% against its long-run average of 16.3%, with the 'safe haven' becoming more volatile over the past 21 trading days than any time since the panic phase of the global financial crisis which followed the collapse of Lehman Brothers in autumn 2008.

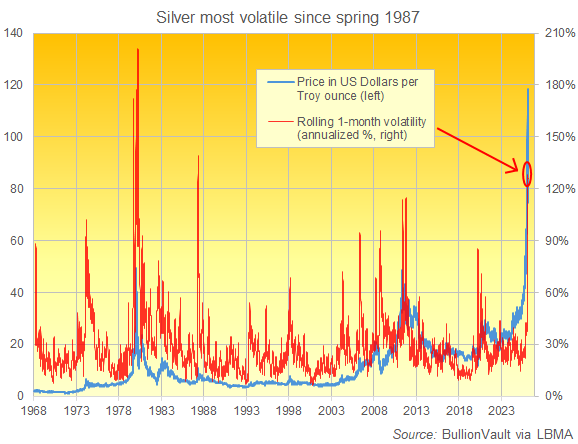

Volatility in London silver bullion prices has meantime spiked from 44.6% this time last month − already close to twice its long run average − to more than 126% today, running at what former Tokyo trader Bruce Ikemizu of the Japan Bullion Market Association calls "a terrifying level".

Long term, the past 21 trading days' swings in silver at new all-time high prices put its rolling 1-month price volatility at the highest in almost 39 years, back when the industrially-useful precious metal jumped by 31.6% inside 2 days before reversing it all in the following session.

"Silver has been rediscovered by investors," the LA Times quoted a precious metals advisor on 27 April 1987.

"Historically, silver is still cheap," a bank trader told the paper, also pointing to rumors of tightening supply and strong demand.

But "It was chaotic...a very emotional day," the New York Times of 28 April 1987 then quoted the head of precious metals trading at Goldman Sachs' J.Aron unit after silver prices crashed − and the Dollar rose on the FX market − following comment from the Reagan White House about wanting the US currency to rise in value.

"Everyone had been so bullish that they all loaded up," said the New York head of precious metals trading at Swiss bank UBS.

"Once the selling started, there were simply no buyers. It was complete bedlam."

Fast forward to February 2026, and "This exceptionally high volatility [in precious metals] is likely to have affected investor confidence," reckons analysis from German financial services group Commerzbank.

"But now the markets have stabilized, you're seeing dip buying," counters Aakash Doshi, global head of gold strategy at giant US asset managers State Street.

"What I think ultimately happened is that [last week's crash] was more of a technical correction. The markets were overbought, overextended but then not necessarily over owned. And I think that's a key difference."

"The immediate catalyst of the swings was the nomination in late January of Kevin Warsh to head the Federal Reserve," says a note from Swiss bank UBS, "which eased fears that the appointment of a more dovish candidate could accelerate the recent weakening of the US Dollar."

"He's gonna be great, he's a really high quality person," said US President Trump to Fox News overnight, complaining that he "made a mistake" by appointing Jerome Powell instead of Warsh back in 2018.

"If he does the job he's capable of, we can grow at 15%, even more."

With US employment data due Wednesday and inflation data due Friday, today's US retail sales figures missed analyst expectations, showing 0% change in December from November.

Back in the precious metals market today, "The recent bout of volatility has called into question the value of gold as a hedge against geopolitical and market swings," says UBS.

"We believe such worries are overdone, and that the rally in gold will resume."

Email us

Email us