Highest Real Rates in 18 Years Fail to Dent Gold and Silver's Huge 2025 Gains

GOLD and SILVER PRICES rallied on Tuesday from an overnight dip, trading close to last week's all-time highs in London as global stock markets fell and longer-term interest rates slipped from multi-month highs amid poor manufacturing, services and jobs data.

Gold recovered more than $60 from last night's drop to $4274 per Troy ounce − a new all-time gold price record this October − while silver rebounded by $1 per ounce to touch $63.85.

Major government bond prices steadied, capping down the yield offered to new buyers of 10-year US Treasury debt at yesterday's 3-month highs around 4.16% per annum.

Inflation-protected Treasury bonds also rose in price, pushing down the 10-year TIPS yields to 1.90% from yesterday's 4-month highs around 1.94%.

For gold, "Secular upside [remains] dominated by GeoMacro regime change," says a new 2026 outlook from metals strategist Nicky Shiels at Swiss bullion refining and finance group MKS Pamp, predicting a gold price high of $5,400 sometime next year.

While it now looks "late-ish" in this gold price move, Shiels says, the world is "early [in a] debasement cycle," says Shiels, calling gold for 2026 "a strategic allocation with reduced sensitivity to real yields or the Dollar."

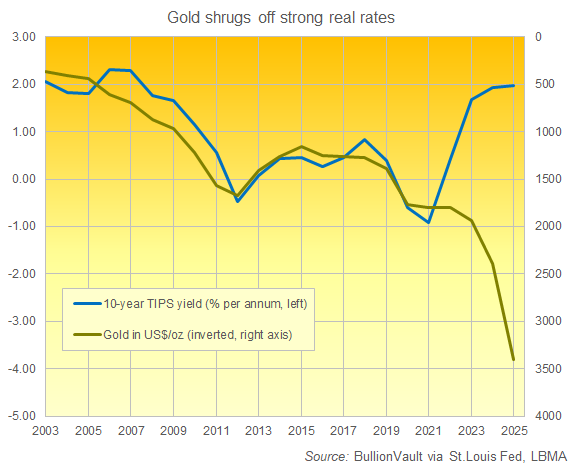

So far in 2025, the real yield on 10-year inflation-protected US Treasury TIPS has averaged 1.97% per annum, edging upwards from 2024 to the highest since 2007.

Gold bullion has meantime risen by more than 65%, marking its sharpest annual gain since 1979 despite the strength of real interest rates − formerly a strongly negative indicator for gold.

Between 2003 and 2021, Dollar gold prices and 10-year TIPS yields showed a significantly negative r-coefficient on average of -0.73 on a rolling 12-month basis.

That number would read -1.0 if they moved exactly opposite, or +1.00 if they always moved together.

But since Russia's invasion of Ukraine starting in 2022, the relationship between the gold price and US TIPS yields has moved to a median reading of +0.02 over the past 4 years.

"The downside concerns [for 2025 were] USD interest rates and the gold price itself," said Keisuke Okui of Japanese conglomerate Sumitomo, predicting an average gold price of $2925 per Troy ounce for this year and currently set to win trade association the LBMA's 2025 forecast competition.

"Not many market participants [were] expecting USD interest rates to continuously go lower. The price of gold itself [was] already relatively high compared" to 2024.

Less than $200 above the average analyst forecast, Okui's forecast is now 14.0% below gold's 2025 out-turn to date of $3400 per ounce.

"The rally has been fuelled by a supercharged geopolitical and geoeconomic environment," says new analysis from Chinese-owned London bullion bank ICBC, "combined with generalised US Dollar weakness and marginally lower interest rates."

Today's preliminary PMI surveys said that manufacturing activity is shrinking this month in Japan, the Eurozone and the UK, while growth in the services sector is slowing worldwide.

US employers added more jobs than expected on delayed data for November, but the jobless rate rose to 4.1%, and UK unemployment also hit a 4-year high on today's data, rising to 5.1%.

"These dynamics have driven a broad push for portfolio diversification amid lacklustre bond returns and concerns over frothy equity valuations," says ICBC.

"Against this backdrop, investment demand for gold has surged across regions, while central banks have continued their buying spree."

Silver's rebound on Tuesday put the more industrially-useful precious metal almost 120% higher across 2025.

Email us

Email us