Gold Finally Rejoins Silver at New Record Price on Fed-Led Liquidity

GOLD JUMPED on Friday to set a new all-time record price at London's 3pm bullion auction, finally topping October's benchmark high while silver set a new all-time record for the 5th day running as analysts said ample financial liquidity worldwide will only get boosted by this week's US cut to Fed interest rates.

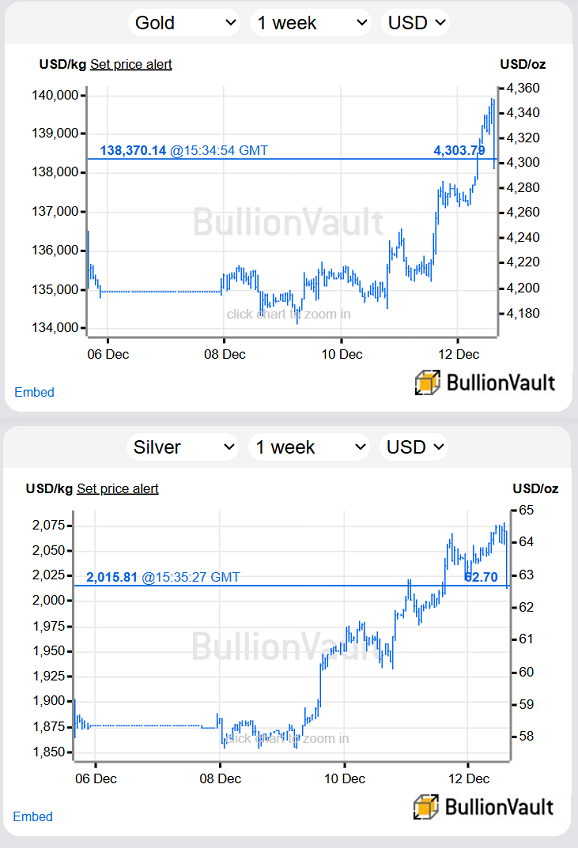

Gaining well over $6 this week, silver fixed above $64 per Troy ounce at its midday market-clearing auction.

Gold meantime added $100 per ounce from last Friday's 3pm benchmark, fixing around $4343 and trading within $30 of mid-October's spot-market gold peak − before immediately dropping back to $4300.

"Record-low junk bond spreads, soaring stock prices, and gold’s extraordinary rally prove that monetary policy is [already] very accommodative," says Vincent Deluard, director of global macro strategy at brokerage StoneX.

Now "Rate cuts, the end of quantitative tightening, the simultaneous acceleration in M2 [money supply data] in Europe, Asia and the US, financial deregulation, and the rebound in inflation will further ease financial conditions in the coming months.

"Enjoy the growth surge and buy inflation protection."

Silver prices today rose 10.9% from last Friday's bullion benchmark, the sharpest weekly gain since August 2020, before diving back below $63 as London trading drew to a close.

"Does 'overbought' exist in the 'debasement trade'?" asked one trading 'guru' on X this morning, pointing to silver's price surge.

"Retail − mostly all on margin − has driven the last $7," warns Nicky Shiels, strategist for Swiss bullion refiners and finance group MKS Pamp.

"Vaults are filling up and refiners are backlogged with scrap."

Like industrial precious metal silver, base metal copper also set fresh record highs in London this week following the US Fed's rate cut and launch of 'not QE QE' Treasury debt purchases.

After LME 3-month copper contracts hit a new record high on Thursday at $11,800 per tonne, New York's CME copper futures for March traded today above the equivalent of $12,000 per tonne, "attracting the metal" into US warehouses as French bank BNP Paribas' analyst David Wilson notes, even after US stockpiles soared this year amid President Trump's on-off import tariffs threats

"This idea that there’s no copper is misleading," says Wilson, "but this draw of copper units into the US is creating a perception of the ex-US tightness.”

Unlike gold and silver, rich-world stock markets edged back Friday from yesterday's new record high on the MSCI World Index.

Down 12.5% this week, shares in cloud computing giant Oracle (NYSE: ORCL) sank after its quarterly earning missed analysts' consensus forecasts by less than 1%.

AI chipmaker Nvidia (Nasdaq: NVDA) meantime traded unchanged for the week Friday, putting its year-to-date gains at 31.0%, after President Trump stopped blocking its exports to China, in return for the Treasury taking 25% of the sales revenue.

The USA's total trade deficit shrank in September to the smallest in 5 years, new data said yesterday, thanks to a surge in exports of gold bullion, primarily to Switzerland, following the President's clear statement that "Gold will not be tariffed" following confusion by industry and US Customs officials in August.

September's outflow reverses the pattern seen before Trump's 'Liberation Day' announcement on tariffs in April, when US dealers booked record shipments − as did importers of most physical goods − to try beating the threat.

"Any new Fed chair is gonna have to investigate and think about who's doing a good job and who's not doing a good job," said Trump advisor − and Fed chair frontrunner − Kevin Hassett this week, attacking "Fed people, from regional presidents all the way up to people at the top, [who] go on and on and on about tariffs, even falsely asserting that tariffs could be inflationary."

But with current chair Jerome 'Too Late' Powell still in post until May, the Federal Reserve yesterday unanimously reappointed all 11 sitting regional presidents for another 5-year term starting im March, a move not usually made until February of those years ending in a 1 or a 6.

Trump's Treasury Secretary Scott Bessent last week said he wanted all new regional Fed presidents to have lived in their respective district for 3 years or more before appointment.

Email us

Email us