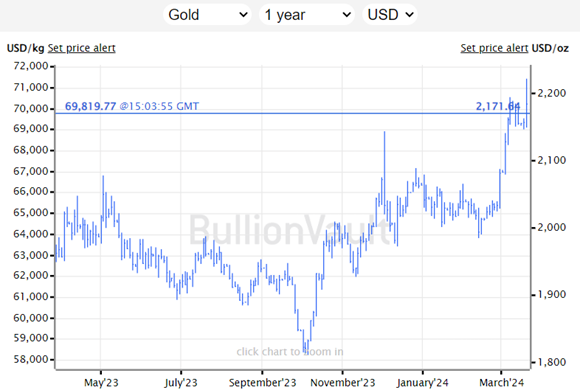

Gold Prices Retreat from New All-Time Highs in All Major Currencies

GOLD PRICES retreated on Thursday after rallying to fresh all-time highs in all major currencies overnight as Federal Reserve policymakers held interest rates steady and maintained their outlook for three cuts this year, despite recent hotter-than-expected inflation data writes Atsuko Whitehouse at BullionVault.

The Bank of England meanwhile maintained UK interest rate at 5.25% for the fifth consecutive meeting on Thursday, even though inflation dropped on yesterday's data for February.

In contrast, the Swiss National Bank (SNB) cut its main interest rate by 25 basis points to 1.50%, marking its first rate cut in nine years and the first for any major central bank to ease monetary policy aimed at addressing inflation.

“The weekly closes tomorrow for gold & silver will be important, but even softer closes won’t take away from fact that the Fed has moved the inflation goalposts ahead of elections,” said Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp.

The Dollar index – a measure of the US currency's value versus its major peers – rose 0.4% to the highest in 2 weeks.

Spot gold in the US Dollar fell to $2180 per ounce on Thursday afternoon after climbing to a record high of $2222 on Wednesday evening, nearly $30 above the previous 'record gold high' on 8 March 2024.

Wholesale bullion in Euro terms surged 1.3% above its prior high to reach €2033 on Wednesday, while the UK gold price in Pounds per ounce touched £1737, some 1.7% above the peak set in early March 2024.

Watch or listen to our Gold Market Reports on YouTube.

The yellow metal then cut its overnight gains, trading back at €2003 and £1715 on Thursday.

Meanwhile, gold prices in Swiss franc surged to a fresh all-time high at CHF 1976 per ounce on Thursday as the franc fell more than 1% against the US Dollar after the SNB’s decision.

Email us

Email us