'Time for Gold Sales' by IMF and Italy to Cut Debt

PRECIOUS METALS rose against all major currencies again on Wednesday, with gold topping $4100 despite the return of calls for gold sales by major holders the IMF and Bank of Italy.

"The gold reserves managed and held by the Bank of Italy belong to the State, in the name of the Italian people," says an amendment to Italy's 2026 proposed Budget Law signed by Lucio Malan, leader in Rome's Senate of Prime Minister Giorgia Meloni's Brother of Italy party.

Political calls to use the Bank of Italy's gold to cut Rome's fiscal deficits or debt include a 2004 proposal by then Minister of the Economy Giulio Tremonti, a 2007 attempt by the coalition government of Romano Prodi, a 2014 attempt during the brief premiership of Enrico Letta, another from the left-right coalition of the Lega and Five Star Movement parties in 2018, plus − most notably − a law aiming to tax unrealized gold profits introduced in 2009 by Tremonti during Silvio Berlusconi's time as prime minister.

That attack on the "institutional and financial independence" of the Banca d'Italia was rebuked by the European Central Bank.

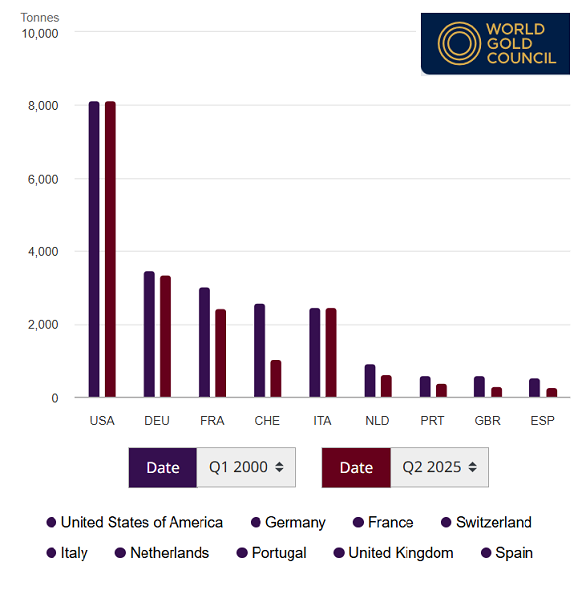

Meloni in 2014 called gold "the only guarantee and relative wealth left to Italians," but the Bank's holdings of 2,451 tonnes − the 3rd largest national central-bank gold holding on official data behind the USA and Germany, and the only major European holding not to have shrunk so far in the 21st Century − remain central-bank property, unavailable for financing the public purse.

"Africa is grappling with an unprecedented debt crisis," says a report meantime for the G20 group of nations, meeting later this week in Johannesburg.

Commissioned by the G20's 2025 president nation South Africa and led by its former Minister of Finance Trevor Manuel, "More than half of Africa’s 1.3-billion people live in countries that spend more on interest payments than on social issues such as health, education and infrastructure," says the report.

"The proposal would focus on refinancing rather than rescheduling debt obligations...Funding could involve the use of SDRs or the sale of IMF gold, if supported by G20 shareholders."

The IMF in 2009-2010 sold 403 tonnes of gold, half of it to the Reserve Bank of India in a direct gold sale and the rest in market transactions.

The Washington-based fund then gave 1/3rd of the profits from those sales to IMF member nations, on the understanding that 90% of the money would be put into the organization's Poverty Reduction and Growth Trust.

With gold prices today rallying 3.3% from Monday's 1-week low beneath $4000 per Troy ounce, silver rose above $52 per Troy ounce for the first time since Friday.

That left 'safe haven' gold 5.7% beneath mid-October's record high in US Dollar terms, with silver prices just 3.9% beneath last week's test of last month's new all-time silver peak.

Western stock markets rallied meantime, snapping a 5-day stretch of losses on the MSCI World Index.

Led by a plunge in hyperscalers investing heavily in what many believe is an AI bubble, that was the longest stretch of falling equities in rich-world economies since April 2024, when a warning from Washington that Iran was planning an 'imminent' attack by Israel coincided with a run of new all-time record gold prices, driven by Chinese private investment gold demand.

So-called cryptocurrency Bitcoin also rallied Wednesday after falling to new lows for 2025 beneath $90,000.

Among the world's wealthiest economies, Italy has the worst national debt-to-GDP ratio outside of Japan's 237% ratio, running at 135% on last year's figures and followed by the USA at 124% and then France at 113%.

Email us

Email us