US Stagflation Keeps Gold at Record Price Before the Fed Cuts Rates

GOLD PRICES continued trading at last week's new record highs on Monday as market attention focused on this Wednesday's universally expected cut to interest rates from the Federal Reserve amid growing talk of stagflation hitting the US economy, writes Atsuko Whitehouse at BullionVault.

Last week's weak jobs data, plus a rise in US inflation, means that economic "expectations have been turned around," says Columbia Business School economist Brett House, blaming President Trump's policies and "their erratic implementation."

So, for analysts and investors, "We've seen growth forecasts for the remainder of this year cut substantially, and we have seen inflation forecasts pushed up."

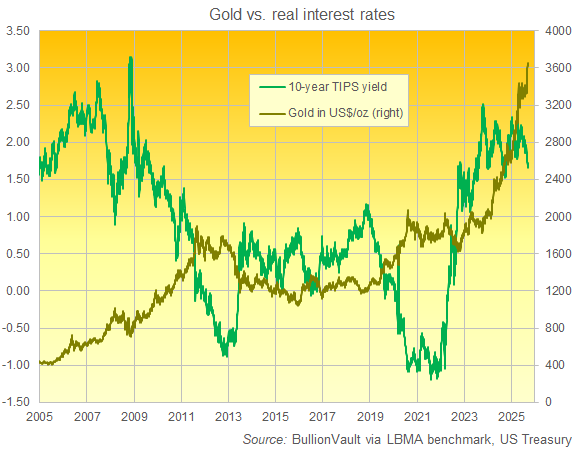

Monday's trading saw the real US interest rate − as implied by the yield on inflation-protected 10-year TIPS bonds − fall to a 2-year low of 1.67% per annum.

That suggests debt traders expect the underlying cost of living to rise faster while the US central bank cuts the cost of borrowing, a pattern which would chime with the 'stagflation' outlook.

Up until the post-Covid surge of inflation, gold showed an increasingly strong negative relationship with inflation-adjusted bond yields, rising when real interest rates fell and vice versa.

But while that relationship broke down in 2022, with gold shrugging off a steep rise in real interest rates, it has suddenly reasserted itself as US jobs data weakens and inflation ticks higher.

With a perfectly negative relationship giving a reading of minus 1.00, the correlation of gold with 10-year TIPS yields today strengthened to minus 0.94 on a rolling 22-day basis, the strongest such reading since February 2023.

"It's more likely a dovish 25 basis point cut versus a hawkish 50bp cut," at this week's US central bank meeting predicts Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp, "as the Fed gambles on the balance of dual mandate risks" between supporting growth while curbing inflation.

Gold bullion today matched last Tuesday morning's record-high London benchmark price of $3654 per Troy ounce − and also rebounded towards all-time highs in most other currencies − after setting gold's 15th new weekend high of 2025 to date on Friday.

New data Friday said US consumer sentiment is falling for a second straight month, down to the lowest level since May.

The University of Michigan's survey also said consumer expectations for inflation over the next year are unchanged at 4.8% per year, contrasting with the latest reported rate of 2.9%.

However, consumers' expectations for inflation over the next five years have risen to 3.9% from 3.5% last month, with 3-in-5 respondents providing unprompted comments about the cost impact of Trump's tariffs during their survey interview.

The price of silver – which finds nearly 60% of its annual demand from industrial uses – also rose back towards last week's peaks, edging near new 14-year highs above $42.30 per Troy ounce.

Fresh US data Monday said that manufacturing activity around New York has suddenly and unexpectedly weakened so far this month, with the Empire State Manufacturing Survey giving its first negative reading since January.

September's meeting of the Federal Open Market Committee (FOMC) kicks off Tuesday and concludes Wednesday, with the central bank's latest policy decision due to bring an update to the FOMC's quarterly Summary of Economic Projections (SEP), the so-called "dot plot" forecasts.

Email us

Email us