Gold $50 Off Record Price as China, India Demand Falls

GOLD PRICES traded at 3-session lows on Thursday, down $50 per ounce from Tuesday's fresh all-time record high as demand continued to fall in China and India, the world's major jewellery consumer markets, while US jobs figures worsened but inflation rose on August's data.

Initial claims for US jobless benefits hit a 4-year high last week, the Department of Labor said today.

Consumer price inflation meantime held at 3.1% on the 'core' measure for August but rose to a 7-month high of 2.9% when food and fuel costs are included.

After making a 'shooting star' with Tuesday's new gold price record, bullion in London had already fallen in early Thursday trading to $3622 per Troy ounce, cutting this week's gain to less than 0.8% the Dollar.

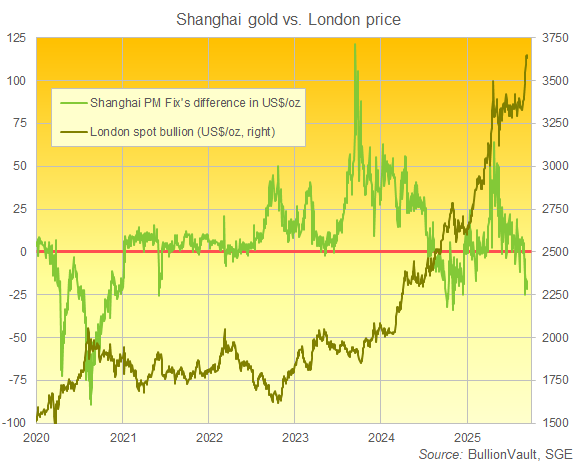

But gold in Shanghai was $17 cheaper than that, offering a negative deal for new imports into China, the world's No.1 gold consumer market.

Shanghai gold has now traded at a discount to London prices for 2 weeks straight. That's the longest unbroken stretch since the 8-week run ending in late-December 2024 capped a 4-month of near-unbroken discounts.

Starting with the London price's first-ever rise through $2500 per Troy ounce last August, that run of Shanghai discounts coincided with 19 further new all-time highs for the global gold price.

China's record-long gold discounts of the 2020 Covid Crisis coincided with global bullion prices rising by almost 1/5th, setting a run of then new all-time highs that summer.

Consumer purchases so far in 2025 has shown a marked switch from gold jewellery to investment demand in China, a pattern also seen across the Middle East, where total demand by weight has held firm over the past decade but gold coins and retail investment bars now account for more than 2/5ths by weight, twice the proportion 10 years ago.

Over in No.2 consumer nation India, gold prices have now risen over 50% from this time last year, "making purchases significantly more expensive" during the country's fast-approaching festival season − climaxing with the peak gold-buying days of Diwali next month − says Prithviraj Kothari of Indian dealers RiddiSiddhi Bullions.

"While weddings and festivals will support some essential buying, discretionary demand is expected to weaken [perhaps by] 15–20% in volume terms, as consumers either downsize purchases or shift toward lighter designs."

Last month's Hindu festival of Raksha Bandhan and Kerala State's Onam celebrations saw sales fall by more than a quarter from 2024, according to the India Bullion & Jewellers Association (IBJA), the steepest such drop in 3 years.

Meantime in equities, China's CSI300 stock index today jumped towards 4-year highs, adding 19.0% in Yuan terms for 2025 to date, while India's BSE stock index edged up to a 2-week high despite US President Trump threatening both nations with 100% US trade tariffs if they don't cut ties with Russia over Moscow's continued invasion of Ukraine.

European shares also hit a 2-week high, and the US S&P500 set its 3rd new high in a row despite the political fall-out from the assassination of right-wing activist Charlie Kirk.

Silver outpaced the gold price, rising back to $41.30 per Troy ounce to show a 1.3% gain for the week so far, some 25 cents beneath Tuesday's 14-year high.

Email us

Email us