Gold Prices Tight, Crude Oil Drops Amid Russia-Ukraine 'Peace Plan' Talks

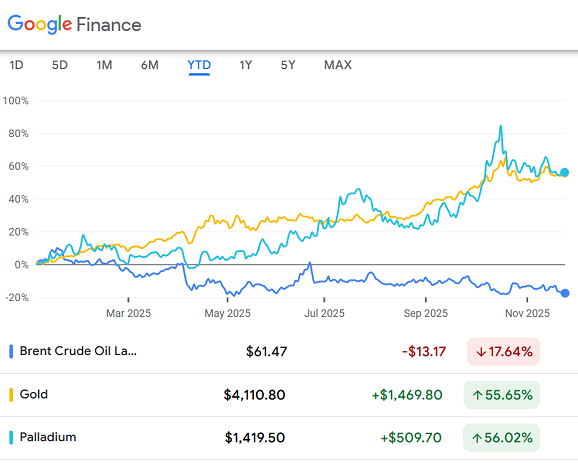

GOLD PRICES steadied on Monday in the middle of last week's tight trading range as global stock markets rallied but palladium slipped and crude oil extended its drop as Europe and Ukraine discussed the US "peace plan" for the central European nation reportedly drafted by invader and major commodities-producer Russia, writes Atsuko Whitehouse at BullionVault.

Spot gold prices traded between $4040 and $4080 today after reversing last week's dip below $4000 per Troy ounce on renewed expectations that the US Federal Reserve will cut interest rates next month.

The move came as US President Donald Trump pressed Ukraine's Volodymyr Zelenskyy − currently fighting a massive corruption scandal in Kyiv − to accept Washington's 28-point peace proposal, aimed at ending 4 years of full-scale war by ceding territory to Russia under Vladimir Putin.

Crude oil in contrast fell again, extending last week's drop of 2.8% for European benchmark Brent as prospects for a Ukraine-Russia peace deal risked adding supply from the world's No.3 producer nation onto an already saturated global market.

The price of Russia's Urals Blend crude oil today sank to 6-month lows close to $52 per barrel, while the price of palladium – of which Russia is the No.1 miner, producing 40% of global annual mine output – fell 0.4% to $1374 per ounce, following a 1.5% decline last week.

London palladium prices had leapt to all-time highs above $3000 in March 2022, far outpacing gold, when the London Bullion Market Association (LBMA) announced 2 weeks after Russia began its all-out invasion of Ukraine that newly cast Russian gold and silver bars would no longer be acceptable as Good Delivery, a move which the London Platinum Palladium Market followed one month later.

US sanctions on Russian state-owned Rosneft (ROSN.MM) and private firm Lukoil (LKOH.MM), which took effect last Friday, could be lifted if a peace plan is signed, the Trump administration says. Oil prices had surged around 5% after the US announced its sanctions on 23rd October.

"Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions," says the latest daily gold-price and precious metals note from Rhona O'Connell at brokerage Stone X Group Inc.

"[While] the momentum has slowed...[and] with the Fed debate taking more headlines [alongside] geopolitical swings, especially vis-à-vis Ukraine, gold is still likely to catch a bid," says O'Connell, forecasting tight range-bound trade between $4000 and $4100.

Platinum, for which Russia is the second-largest producer with roughly 10% of global mining supply, edged 0.1% lower on Monday to $1520 per ounce after making a 2.6% weekly decline.

Silver prices, with Russia contributing roughly 10% of global mining supply, edged 0.2% higher to $50.13 per ounce, following a 3.9% weekly decline.

With key US economic data continuing to return after the end of Washington's record-long US government shutdown, the odds of a December rate cut from the Federal Reserve – seen as just 42% a week ago – have now risen to 75% according to the CME's FedWatch tool.

This week will bring delayed retail sales figures, the US producer price index, and durable goods orders.

The Dollar Index – a measure of the US currency's value versus major peers – edged 0.1% lower today from its highest level since May.

European stocks pared earlier gains after Asian stocks rose, with the MSCI Asia-Pacific Index up 0.5%.

Gold priced in Euros and UK Pounds meanwhile traded in tight ranges around Friday's closes at €3530 and £3113 per Troy ounce respectively.

The yellow metal priced in Japanese Yen rose 0.3% to ¥20,515 per gram, similarly a new all-time high in mid-October, as the JPY recovered slightly from its weakest levels on the FX market since last New Year's near 4-decade lows amid growing investor concerns new Prime Minister Sanae Takaichi's budget deficit stimulus spending plans.

Crypto-currency Bitcoin fell further, putting its loss at more than 20% across November – its worst month since the 2022 crypto crash – with a year-to-date drop of 7.5%.

"The pool of safe havens within the [US Dollar] debasement trade is shrinking," says Nicky Shiels, head of metals strategy at Swiss refining and finance group MKS Pamp, "with Bitcoin and the JPY reversing trends."

As of Friday, gold priced in US Dollars had risen 56% so far this year, with silver up 73% as platinum and palladium gained 67% and 53% since New Year's Eve respectively.

Email us

Email us