Gold Sets New London High as China's SCO Challenges Trump

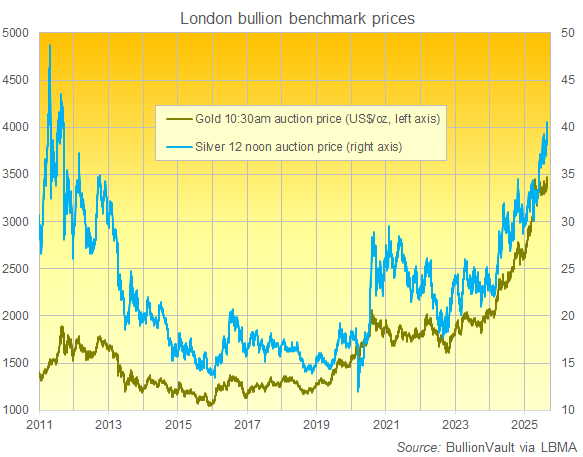

GOLD PRICES climbed to all-time highs at London's bullion market auctions on Monday, while silver rose to a new 14-year high above $40 per Troy ounce as the US Dollar weakened together with Western government bond prices, writes Atsuko Whitehouse at BullionVault.

The move came amid growing concerns over the future of the Federal Reserve's political independence, plus uncertainty surrounding President Donald Trump's trade tariffs and a very public handshake between the leaders of so-called BRICS economies China, Russia and India.

"We must continue to take a clear stand against hegemonism and power politics, and practise true multilateralism," said SCO host President Xi Jinping, referring to Trump's policies.

Gold prices in London – the world's central hub for trading and storing precious metals – rose 1.2% to fix at $3469 per Troy ounce at Monday morning's 10:30 auction, topping the 22 April record by $15.

Having already set gold's 7th new month-end and month-average price records of 2025 last Friday, London prices then rose further as the City's 3pm benchmark auction approached, fixing around $25 below the brief print of $3500 gold seen in April's spot-market trading.

Silver bullion meantime surged 4.6% to $40.58 at London's midday auction, its highest level since September 2011.

The strength in silver pushed the Gold/Silver Ratio – which tracks the relative prices of the two former monetary metals – down to just above 85, the lowest level for 'safe haven' gold versus 'industrial' silver since December 2024.

"The trigger for gold's rise was the uproar over Fed Governor Cook's dismissal," says Bruce Ikemizu of the Japan Bullion Market Association.

"Further interference in a supposedly independent Fed," agrees German refining group Heraeus, "could ultimately lead to higher inflation if, for political reasons, interest rates are kept lower than the economy might need."

"That could be good for the gold price in the longer term."

Gold prices in Japanese Yen also hit a record high for the second consecutive session on Monday at ¥16,470 per gram as the currency was the only major currency to weaken against the US Dollar for a second session.

The Dollar Index – a measure of the US currency's value versus its major peers – extended its losses for a third consecutive session, reaching its weakest level since 25th July. With US markets closed for the Labor Day holiday, trading volumes remained subdued, according to one FX analyst.

"Global movements against the US may also be accelerating the trend," says Ikemizu at JBMA.

The leaders of China and India − the world's top two gold-consuming nations − discussed on Sunday ways to increase and balance bilateral trade, strengthen people-to-people links, cooperate on trans-border rivers, and jointly fight terrorism, according to India's Foreign Secretary Vikram Misri, also attending the SCO meeting.

India's Prime Minister Modi was in China for the first time in seven years, meeting President Xi alongside Russian President Vladimir Putin, who met in Alaska last month with US President Trump to discuss Moscow's invasion of Ukraine, but with no progress.

The US has doubled its 25% tariff on India with an additional 25% penalty, tied to India's continued purchase of Russian oil. At the same time, the US and China agreed to extend their tariff truce for another 90 days until 10th November, with US tariffs on Chinese goods remaining at 30%, while China's tariffs on US goods stay at 10%.

President Trump, however, warned of possible 200% tariffs on Chinese goods if China restricts exports of rare-earth magnets.

Gold prices on the Shanghai Gold Exchange today rose 1.6% to ¥795 per gram, the highest Yuan price since the all-time peak of 22nd April. But prices continued to show only a small premium to London, offering an import incentive of less than $4 per ounce – approximately half the typical level.

Gold bullion in Euros rose 0.7% to €2959 per ounce on Monday, still €45 below April's all-time London benchmark high, while the UK gold price in Pounds per ounce also gained 0.7% to £2563 – less than £20 below its daily LBMA price peak – as both currencies strengthened against the greenback.

UK Pound prices for silver – primarily an industrial metal, with nearly 60% of annual demand coming from industry – hit a new all-time record of £30.01 per ounce, surpassing the previous high from April 2011 by 30 pence.

Silver priced in Euros rose to €34.55, exceeding 2011's record peak − the highest since the single currency launched in January 1999 − by nearly €1 per ounce.

European stocks steadied on Monday, with the pan-European Stoxx 600 edging 0.2% higher after Friday's selloff in US technology stocks was followed by today's Labor Day holiday shutdown across US securities exchanges.

Email us

Email us