Weak US Retail Sales See Gold Price Recover $2000 After Inflation Drop

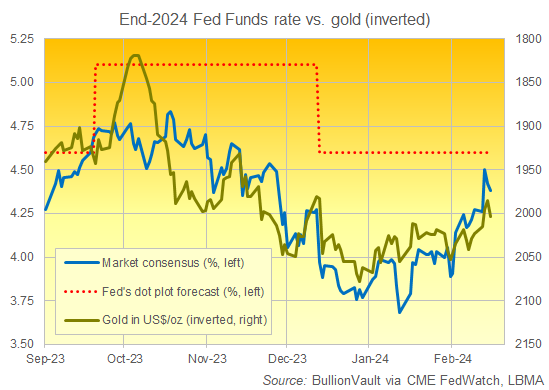

The PRICE of GOLD rallied back through $2000 per Troy ounce in London on Thursday, recovering half of this week's earlier 1.9% drop – made on stronger US inflation data – after retail sales for January missed analyst forecasts.

Email us

Email us