Silver Ratio Dive Bombs vs. Gold

Might silver's low price to gold signal a surge ahead...?

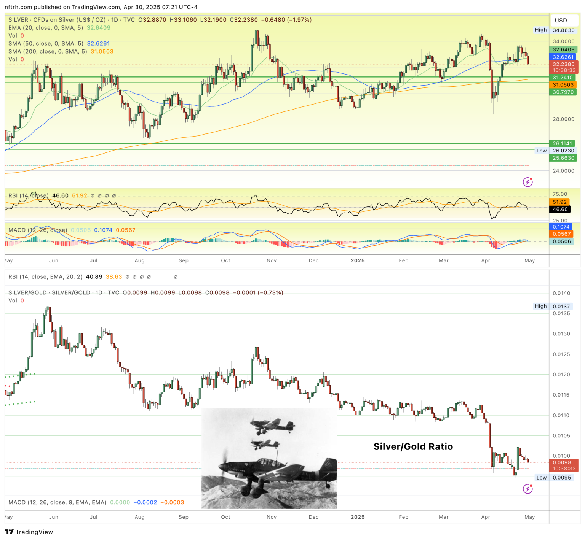

NO REVERSAL yet in the Silver/Gold ratio, writes Gary Tanashian in his Notes from the Rabbit Hole, flipping the more common Gold/Silver Ratio on its head, the better to measure silver in terms of the less useful 'safe haven' precious metal.

In fact, quite the contrary as the ratio makes its 5th day fading after a spike last week.

The Silver/Gold ratio, in other words, remains extremely depressed. That in itself is not a big deal. It's a normal consolidation of the spike.

But the nominal silver price, which had been conspicuously strong above its 50-day moving average despite the correction in gold and the miners, is slipping said level.

If that is an indication of things to come, the sector correction should continue and other areas in commodities/resources could come under renewed pressure.

A reversal in the Silver/Gold ratio would trigger a positive market for commodities/resources.

The question is, will the recent dive bomb in the silver price vs. the gold price prove to be a pivotal event, as it did in 2020? Will a reversal in the Silver/Gold ratio come from this drop?

If so, given relatively less downside intensity than 2020, I'd expect the upside to be highly tradable, but more moderate (sorry my silver buggish friends).

(By the way, above, and outside of the P-51 Mustang, the Junkers JU87 'Stuka' dive bomber was this WWII fighter dork's favorite of the era. It's a bomber, but work with me here. It was so awkward and clumsy.)

Silver, with more cyclical industrial utility than gold, would lead if inflationary pressures build up and/or renewed enthusiasm against a coming recession/bust were to manifest.

Further implications would be for strength in the precious metals miners, despite a currently in-process healthy pullback, and further weakness in the US Dollar, which has been bearish for the entirety of Trump's term.

As a side note, USD is due for a bounce or rally. But "due" implies a time variable.

Meanwhile, the TSX-V index, home of the most speculative Canadian commodity/resource related stocks, has ticked a new high for its bottom/upturn cycle. The 'V' seems to think silver will take over from gold, potentially providing a backdrop for wider commodity participation.

Only time will tell if this will play out, but it's interesting goings-on in a macro stimulated by an awful lot of geopolitical input.

Email us

Email us