US Disorder vs. China's New Energy

If 'might is right' then this massive energy build-out will matter...

I HAD the privilege of attending the 2026 Harvard Presidents' Seminar alongside some of the nation's top executives and thought leaders, writes Frank Holmes at US Global Investors.

One of the most compelling speakers was Ambassador Kevin Rudd, former prime minister of Australia.

Rudd spoke with clarity and, yes, concern about the shape of the world we're heading into. The post-World War II, rules-based order – the one that gave us globalization, multilateralism, NATO, the World Trade Organization (WTO), etc. – is likely over.

What comes next appears to be a return to 19th century-style governance, characterized by "might makes right" and spheres of influence.

I wouldn't call Rudd a doomsayer. He's more of a realist who believes, as I do, that a strong US is good for the world. Conversely, a weak US creates dangerous power vacuums that China and Russia are all too eager to fill.

During the 80-year period following World War II, the US took a dominant role in shaping global norms, from open markets and free trade to the expansion of democracy and the US Dollar as the world's reserve currency. We enjoyed relative peace.

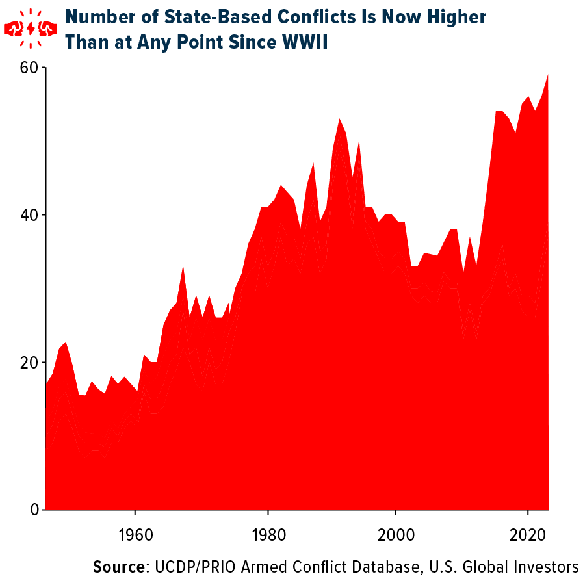

That era, Rudd suggests, may be coming to an end. Democracy appears to be in decline across the globe, while the number of armed conflicts is at its highest level since World War II.

China and Russia aren't hiding their ambitions. Just last week, Xi Jinping and Vladimir Putin affirmed their deepening ties, pledging mutual support on economic, military and ideological fronts. And with the expiration of the New START treaty this month, the last vestige of nuclear arms control between the US and Russia is gone.

Rudd, author of two major books on Xi, warned us that the current Chinese leader is no pragmatist in the vein of Deng Xiaoping, the former leader who jumpstarted the country's ascendancy in the 1970s through meaningful market reform. Instead, Xi can better be described as a Marxist-Leninist nationalist.

Under Xi, China has shifted from playing by the rules to rewriting the rules. The Chinese Communist Party (CCP) is executing a comprehensive strategy across every conceivable domain, including military modernization, industrial dominance, energy independence and much, much more. In October, I shared with you my belief that China's world-spanning Belt and Road Initiative (BRI) is a Trojan Horse.

Xi's government sees economic power and national security as one and the same, and nowhere is that more apparent than in energy and technology.

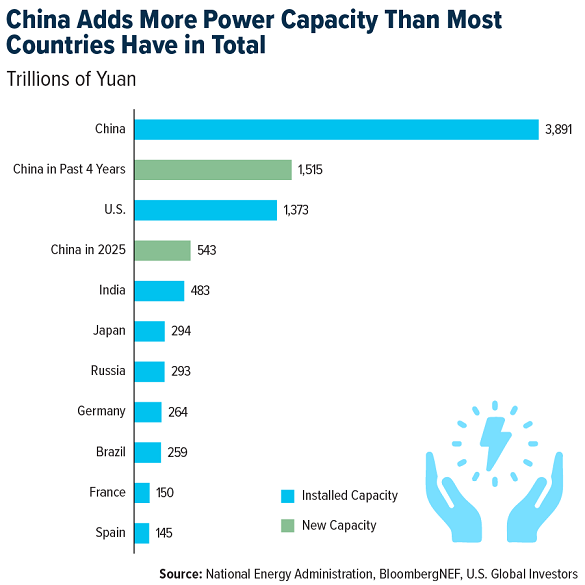

While the US goes back and forth on energy policy, China has been building. Since 2021, the country has added more power capacity than the US has in its entire 250-year history.

Read that again. In just four years, they've eclipsed our entire power infrastructure.

Last year alone, China installed 543 gigawatts of new capacity, an unimaginable amount. That includes solar, wind, coal, nuclear and gas. And according to BloombergNEF, the country will add another 3.4 terawatts of new capacity over the next five years, nearly six times the amount the US is forecast to add.

The goal? To ensure that China's next-generation industries, like artificial intelligence (AI), robotics and advanced manufacturing, aren't held back by energy shortages.

As I've shared with you before, Elon Musk and NVIDIA chief Jensen Huang have both warned that China's monumental power surplus will give it a huge advantage in AI compute.

From what I've heard and read, I have to agree. The numbers are simply staggering. In 2025, clean energy drove over a third of China's GDP growth, accounting for more than 90% of investment increases. Sectors like solar, electric vehicles (EVs) and battery tech contributed over $2.1 trillion to the nation's economy, roughly equivalent to the size of Canada or Brazil's GDP.

If China's clean energy sector were its own country, it would be the eighth-largest economy in the world.

Contrast that with the US, where political gridlock and partisanship have hampered large-scale energy buildouts. China is thinking long-term, whereas officials in the US are too often thinking only about the next election.

In fact, according to a recent report by the Information Technology and Innovation Foundation (ITIF), China is on track to surpass the US across a broad swath of what it calls "national power industries." These include military industries (guided missiles and tanks, for instance), dual-use industries (electronic displays and semiconductors) and enabling industries (automobiles and heavy construction equipment).

To its credit, the US is committed to spending big on defense. Congress just passed a $839 billion bill, which is $8 billion more than the Pentagon even requested. Funds are set to flow to critical platforms like the F-35, B-21 bomber and Sentinel intercontinental ballistic missile (ICBM) systems. More than $13 billion is earmarked for space and missile defense under President Trump's Golden Dome program.

Equity markets may be the first to have recognized that a new investment cycle is underway.

In January, small-cap, domestically focused US stocks began to take leadership. While the S&P 500 reached new highs, gaining roughly 1.4% for the month, the Russell 2000 Index surged 5.4%, significantly outperforming its large-cap peers. Small caps notched a 15-day winning streak against the S&P, the longest such stretch since May 1996.

I don't believe this is a one-off. The Russell 2000 is now outperforming the S&P 500 since the start of Trump's second term, roughly 17% versus 15%, as of Friday, February 6. Some – but certainly not all – small-cap companies are generally less exposed to Trump's tariffs and may benefit over the long-term in a less globalized, interdependent world.

I urge you to do your due diligence before investing, however. An estimated 40% of all Russell 2000 companies are unprofitable right now.

With precious metal prices down from their extraordinary highs, now might also be the time to consider buying the dip. I always recommend a 10% in gold, split evenly between physical bullion and high-quality gold mining stocks. Remember to rebalance on a regular basis.

Email us

Email us