Copper Gets Hot on EVs and Smelting Squeeze

Global PMIs also point to growing demand...

COPPER FUTURES climbed as high as $9,164.50 per tonne on the London Metal Exchange (LME) in mid-March, marking a fresh 11-month high writes Frank Holmes at US Global Investors.

The rally comes hot on the heels of a months-long sideways grind, propelled by supply risks and growing optimism around the global economic outlook.

Contributing to the run-up is news that as many as 15 Chinese smelters are considering output cuts at a recent high-level meeting in Beijing, which ignited a flurry of trading activity that the LME hasn't seen in years.

What's more, an average of 11.5% of monitored copper smelter capacity in China was inactive in the first two months of 2024, compared to 8.6% in the same period last year and 8% in 2022, according to UK-based geospatial data firm Earth-i.

Why are smelters close to cutting supply? Simply put, Chinese operators are facing a crisis over treatment and refining charges, or TC/RCs – fees that are paid to process copper concentrate into refined metal.

TC/RCs have collapsed due to a shortage of concentrate supply, squeezing already razor-thin profit margins. Beyond supply concerns, copper demand continues to be driven largely by the renewable energy boom.

According to the International Energy Agency (IEA), copper's share of total demand across all applications is forecast to surge from 23% currently to over 42% by 2050.

This isn't just hot air. In August 2023, the Department of Energy (DoE) added copper to its official list of critical materials, making domestic producers eligible for government subsidies under the Inflation Reduction Act (IRA). The designation underscores copper's pivotal role in securing a sustainable energy future.

Electric vehicles (EVs), renewable power sources like solar and wind and increasing electrification across the global economy are supercharging copper's demand growth. As I've shared with you before, a single EV requires around four times as much copper as a conventional gas-powered car. All told, EVs could account for nearly 60% of total copper demand by 2030, according to Bloomberg Intelligence.

While the green revolution and electrification efforts are set to drive significant demand for copper, I also believe a compelling argument lies in the reshoring efforts of developed economies. According to Crescat Capital's Otavio Costa, the US and other G-7 nations have neglected significant infrastructure investments for over seven decades, and the emerging deglobalization trends are expected to boost these construction undertakings, with copper positioned as a potential major beneficiary.

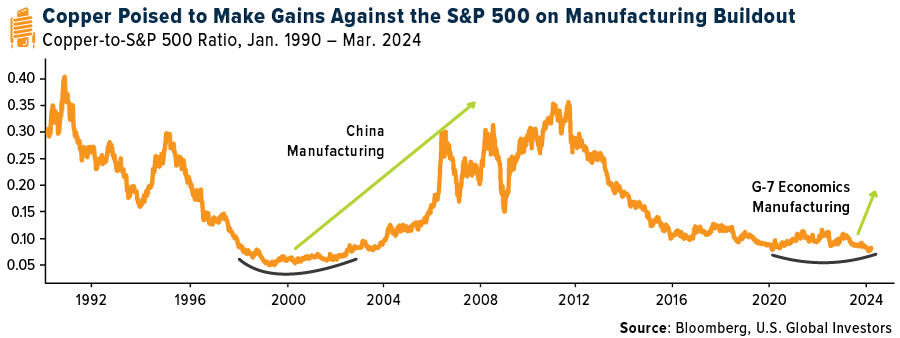

In the chart below, you can see how the copper-to-S&P 500 ratio surged in the early 2000s when China spent heavily on construction. That relationship has collapsed in the years since, but if Costa's prediction is accurate, we may see copper soar again relative to the stock market.

Recent Purchasing Manager's Index (PMI) figures suggest the manufacturing sector is now in copper's corner. The J.P.Morgan Global Manufacturing PMI rose to 50.3 in February, staying in expansionary territory for a second straight month after emerging from an 18-month contraction.

Historically, a cross-above event – when the monthly PMI reading tops its three-month moving average – has signaled higher commodity and energy prices three to six months down the road. If the pattern holds, copper and its industrial peers could get an additional tailwind in the months ahead.

Email us

Email us