AI Gloom vs. Gold Price Boom

Tech over-stretched, gold under-owned...

ARE artificial intelligence (AI) and Magnificent 7 stocks in a bubble? asks Frank Holmes at US Global Investors.

I've been seeing more and more headlines lately speculating that a crash could be imminent, and while I don't hold the same opinion, I do believe that prudent risk management demands that investors consider allocating to risk-off assets, including gold and silver.

Like AI stocks, precious metals look overbought; but unlike AI stocks, they're structurally underinvested. As such, I believe they deserve another look.

In case you've been living around a rock, AI has dominated both public markets and venture capital flows. According to PitchBook, more than 55% of global venture funding this year has gone to AI, with giants like OpenAI, Anthropic and xAI receiving the lion's share.

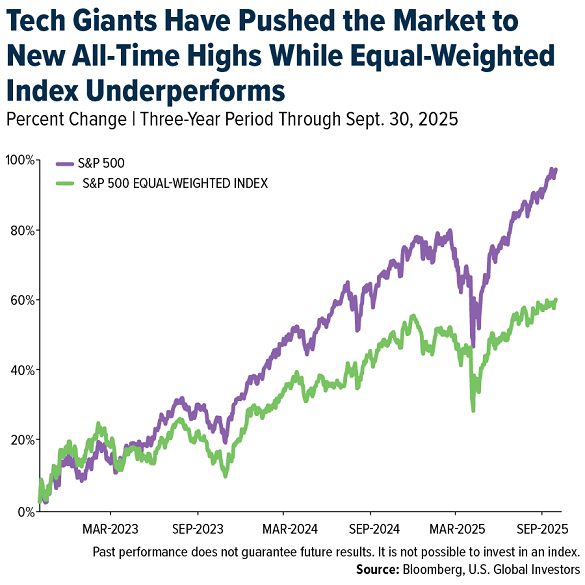

In the public markets, Nvidia, Microsoft and their Mag 7 peers have carried the Nasdaq and S&P 500 to repeated all-time highs, while equal-weight indices lag far behind.

Valuations are stretched. The S&P's forward price-to-earnings multiple sits near 23 right now, on the higher end of the spectrum.

Billionaire hedge fund manager Leon Cooperman told CNBC last week he thinks we're at the stage of the bull market that Warren Buffett cautioned about; namely, irrational exuberance appears to be in control, not fundamentals. The so-called Buffett indicator − the ratio of total US market cap to gross national product (GNP) − surged past 200% last week, meaning equities are now valued at more than double the size of the US economy.

None of this guarantees a crash is coming, of course. But as someone who lived through the internet frenzy of the late 90s, I know what can happen when investor capital collects too narrowly in a handful of names. If an AI pullback happens, it could be sharp.

That brings us to gold and silver, which just posted a historic third quarter. Gold surged 17% to $3,840 an ounce, its largest quarterly Dollar gain on record, according to the Wall Street Journal. Silver jumped nearly 30% to $46.25, its biggest quarterly percentage gain ever, and just shy of its 1980 peak, when the Hunt brothers notoriously tried to corner the global silver market.

Gold and Silver Prices Have More Than Doubled in the Past Two Years

Remarkably, precious metals remain deeply underrepresented in portfolios. In a report dated September 25, Bank of America strategists point out that gold makes up a measly 0.4% of private client assets and 2.4% of institutional assets.

When investors wake up to the need to diversify in a high-valuation, low-yield world, the flood of capital into metals and mining could be massive.

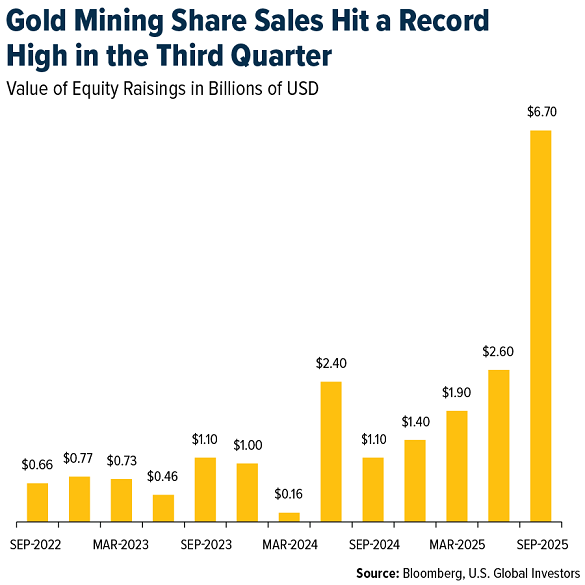

The rally hasn't been limited to physical bullion. Gold mining stocks, long our of favor, are roaring back. Bloomberg reports that the group collectively raised $6.7 billion in equity in the third quarter alone, the highest quarterly total on record.

Major offerings from Hong Kong's Zijin Gold, China's Shandong Gold and Indonesia's Merdeka Gold are leading the rally.

I was pleased to see that Bank of America named gold miners its number one investment theme of 2025, ahead of uranium, defense tech and even AI. That's a huge endorsement in a year when tech and AI have dominated the news.

I would be remiss if I didn't mention that gold and silver are flashing overbought signals right now, whether viewed through standard deviation or the 14-day relative strength index (RSI). Historically, such moves have preceded pullbacks. I wouldn't be surprised if a correction occurred before we see further gains.

Even if precious metals roll over, the losses could be smaller and shorter-lived than a potential AI crash. Hypothetical stress tests conducted by the World Gold Council (WGC) found that adding gold to a diversified portfolio reduced declines by 50 to 90 basis points across scenarios ranging from equity crashes to credit squeezes.

I see a lot of potential opportunity in the underinvestment theme. We're living in a time of extraordinary capital concentration. On one end of the spectrum, trillions are pouring into AI platforms and a handful of megacap stocks. On the other, gold and silver, through breaking records, remain afterthoughts in most portfolios.

Which side do you think offers greater margin of safety today?

Older investors in particular should pay attention. Many no doubt remember the dotcom crash. Even Amazon − today, the world's fifth largest company by market capitalization − plunged more than 90% from peak (December 1999) to trough (October 2001). Over the same period, gold gained about 5% − nothing to write home about, but it certainly helped stem the losses elsewhere.

I'm not suggesting you sell your Mag 7 stocks. Just don't ignore the tried-and-true assets that have helped empires and households alike preserve their wealth for thousands of years.

Email us

Email us