Charlie Munger's American Dream

Buffett's righthand man passed away at age 99...

The LIFE STORY of Charlie Munger, who passed away last week at age 99, serves as a shining example of the enduring American Dream, writes Frank Holmes at US Global Investors.

That's especially so now, at a time when many people doubt whether the promise of a better life is still intact. On the contrary, I believe that Munger's journey, coupled with data from the updated Forbes 400 list, reaffirms that the American Dream still thrives.

Charlie Munger's life began in a modest Midwestern town, far from the glamor of Wall Street. His early years were marked by hardships, including a marriage that ended in divorce, a rarity at the time, which left him with little in the way of assets.

But adversity was not done with him yet. Munger's son Teddy fell victim to leukemia, and Charlie bore the financial strain of his son's illness, paying for everything out of pocket. Tragically, Teddy passed away at the tender age of nine, devastating Charlie.

In the face of such overwhelming challenges – failed marriage, financial ruin, the loss of his beloved son, and then the surgical removal of his left eye following a botched cataract surgery – I suspect it must have been tempting for Munger to surrender to the vices that many others have succumbed to.

Fortunately for him, it was around this time that the future billionaire's path intersected with a quirky investor from Omaha, Nebraska, by the name of Warren Buffett. Together, the two value investors began buying distressed shares in an old textile company called Berkshire Hathaway. The rest, as they say, is history.

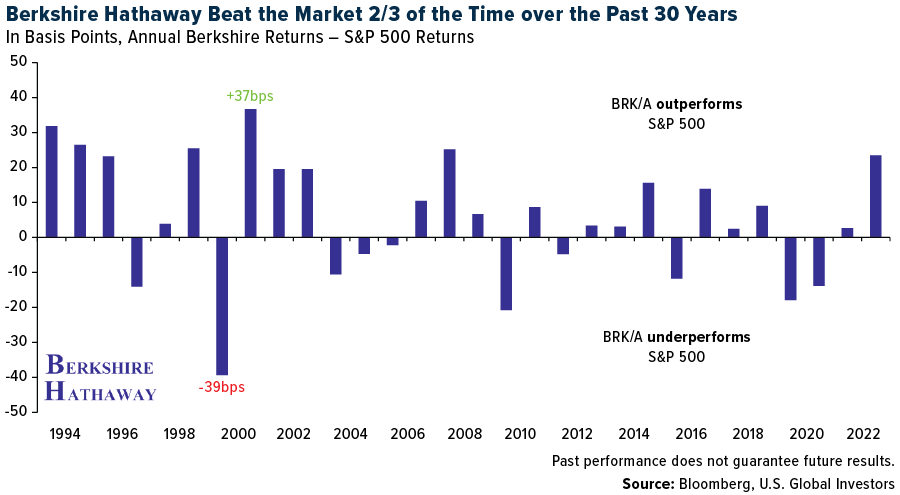

Between 1992 and 2022, Berkshire delivered a compound annual growth rate (CAGR) of 13%, beating the S&P approximately two-thirds of the time on an annual basis. Had an investor bought $100 of Berkshire shares in 1978, when Munger joined the company, that investment would be worth around $400,000 today, far outstripping the S&P500.

James Truslow Adams, the Pulitzer Prize-winning historian who coined the term "American Dream", defined it in 1931 as the "dream of a better, richer and happier life for all our citizens of every rank."

Does the dream still hold true? Today, many Americans can't help but have second guesses.

According to a recent Wall Street Journal/NORC survey, only 36% of American adults still believe in the American Dream, a significant drop from 53% in 2012 and 48% in 2016. Roughly two-thirds of respondents said that the American Dream either once held true but no longer or never held true to begin with. What's more, half of people believe that life in the US has worsened over the past half-century.

It's undeniable that the US faces historic economic challenges right now. Despite higher interest rates, inflation remains sticky, increasing 3.2% year-over-year in October. Homeownership is arguably the most important component of the American Dream, but due to sky-high mortgage rates, housing affordability is at record lows, as are pending home sales.

As dire as this sounds, I'm optimistic that the worst is behind us. Pain is temporary, and hope will prevail.

Don't take it from me, though. The updated Forbes 400 list, released in October, reveals an encouraging trend. Over two-thirds of today's billionaires are self-made, a remarkable increase from less than half in 1984. In 2023, an astonishing 70% of billionaires built their fortunes from the ground up.

Among these self-made billionaires, 29 earned a score of 10, indicating that they once lived below the poverty line or faced significant adversity during their journey to success. The list includes individuals like former Starbucks CEO Howard Schultz, who grew up in a Brooklyn housing project, and David Murdock, the former CEO of Dole Food Company and a war veteran who briefly experienced homelessness.

This diversity of backgrounds and stories within the ranks of the wealthiest Americans underscores the resilience of the American Dream.

In these times of doubt and uncertainty, Charlie Munger's life story reminds us that the American Dream is not a relic of the past. It is very much alive, thriving, and within the reach of those who dare to dream, work hard and persevere through adversity. Munger's journey from the depths of despair to becoming a billionaire and a revered figure in the world of finance speaks volumes about the opportunities that still exist in this great nation.

Let us draw inspiration from his legacy as well as the stories of self-made billionaires who continue to shape the landscape of American success.

Email us

Email us