Same Old Trick, New Inflation

Next set of macro-bailouts will swamp bonds...

OF COURSE it was promoted, and heavily, writes Gary Tanashian in his Notes from the Rabbit Hole.

But bews of Treasury bonds' death was greatly exaggerated.

That is because here in the financial markets exists a great big herd eating the headlines every day, week, month. Succumbing to the popular news of the day.

Indeed, with my Continuum chart, you could say I was in the vanguard of anti-bond sentiment as an indicator I'd used to great effect for keeping cool during phases of inflationary hype actually did break through in 2022. Bond bull over, new macro engaged.

The big picture monthly chart of the 30yr Treasury bond yield has guided us well for many years.

In 2022 we were guided to a Treasury bond bear market, at the long end at least.

With that bear market we now know that what had been for decades no longer is. My strongly held theory is that both fiscal (government) and monetary (Fed) policymakers no longer have the tailwind of disinflationary signaling at their backs as they attempt to inflate in the future.

It's the picture of a market saturated with their policy shenanigans that will be unlikely to comply as had come to be expected circa 2001-2022.

However, in the interim as an expected economic slowdown engages traditional 60-40 portfolio dorks will act as they've always acted, in my opinion. They will buy bonds (or if they've got the 60-40 set up, depend on that 40% weighting).

But the market for longer-term bonds, at least, has gone big picture bearish. So with bullish projections we are talking interim bullishness here and as yet, the long end is no sure thing to bull.

For what seems like forever I've held short-term Treasury bonds in the 0-3yr range along with a couple direct short-term bonds, one of which has already matured and spit out its interest and gains on principal. Not bad considering that cash has also been paying income for so long now. The problem with cash is that its income will be reduced when the Fed starts cutting. Bonds will increase in value as their interest payments decline.

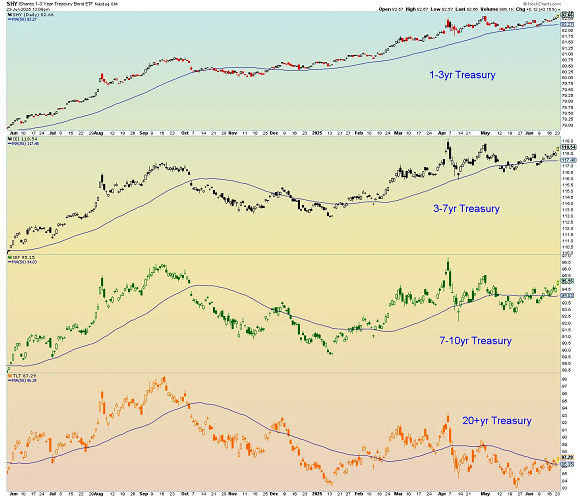

Anyway, here's a daily chart of 1 through 20+ year bond funds. 1-7 years are trending up, 7-10 years are sideways and 20+ years are bouncing within a downtrend. This is well in alignment with a coming recession and continued fade in inflationary macro signaling.

It's all interim, in my opinion. I expect inflation to return, worse than before.

But it's not going to arrive because Trump bombed Iran, driving oil up. It's not going to arrive (meaningfully) because of tariffs and trade wars. Certain assets/markets will pop and drop due to supply/demand. But the next real inflation problem will come when monetary and fiscal policymakers attempt the next macro bailouts.

Same old parlor trick, much less forgiving macro. That's my bet.

Email us

Email us