Gold vs. the Plunge Protection Team

If the US Fed keeps cutting rates, says China, it will "certainly have a harmful effect" on the international currency system...

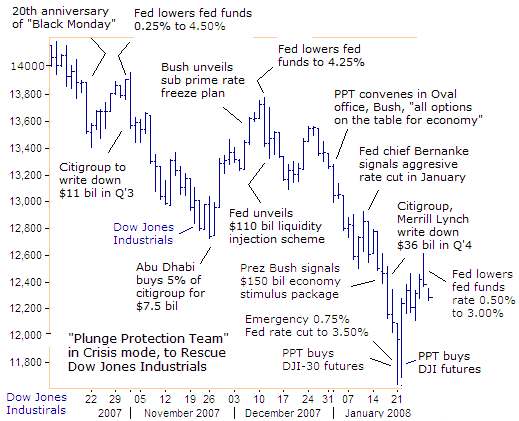

STOCK MARKETS across the globe were gripped by extreme fear and panic on the morning of January 21st. Asian markets found themselves under relentless selling pressure that ricocheted to Europe and Latin America.

Japan's Nikkei-225 melted down by 18% and the Shanghai and Shenzhen stock exchanges took their losses for the first three weeks of January to some six trillion Yuan ($830 billion) of market value wiped out– the worst correction in a decade.

Those stunning losses in Asia spread to European bourses, where Germany's Dax tumbled 7.2%, the French Cac40 plunged 6.8% and Britain's FTSE100 lost 5.5%, their biggest one-day slides since the Sept 2001 terror attacks, wiping out more than $350 billion of market value.

In electronic trading, the Dow Jones Industrial (DJI) futures market plunged 550 points, extending a vicious slide to the brink of a bear market and conjuring up memories of "Black Monday" – the crash of 1987.

On top of all this gloom, recessions in the US economy usually arrive about once every six years, and since the last recession ended in 2002, a downturn in the world's largest economy is probably due in 2008.

Until now, the big threat to US household spending was focused on the slumping housing market, but history suggests that while consumers can withstand one serious blow to their wealth, a double-barreled assault can be disastrous.

So if the stock market kept sliding, it would probably tip the economy into recession. Or so the Federal Reserve decided.

The US Treasury's "Plunge Protection Team" (PPT; more formally known as the President's Working Group on Financial Markets) operates in all three major trading zones – Asia, Europe, and America.

It is always trying to jig the stock market higher and working behind the scenes to prevent the emergence of a bear market.

The key weapons in the PPT's arsenal include brainwashing the media, fudging the US inflation data, Federal Reserve rate cuts, massive Fed money injections, tax rebates, pork barrel spending, and intervention in the stock index futures markets.

Typically, the stock market trades with a six-month time horizon. But unrelenting intervention in the futures markets engineered by the PPT, coupled with big Fed money injections – and the endless flow of cheap capital from Tokyo via the 'Yen Carry' trade –had enabled the Dow Jones Industrials (DJI) to float near record highs in the last quarter of 2007, even though the US economy was already slipping into recession.

When the DJI-30 tumbled towards its August lows on Jan 10th, Fed chief Ben "B-52" Bernanke wasted no time in telegraphing a hefty rate cut, trying to "jawbone" the stock market higher and prevent a slide below key chart support.

"In light of recent changes in the outlook for and the risks to growth, we stand ready to take substantive additional action as needed to support growth and to provide adequate insurance against downside risks," Bernanke declared.

However, with US stock markets off to their worst start in history this year, the illusion that PPT intervention can endlessly provide a "safety net" under the market has evaporated.

After the Dow Jones Industrials plunged 550 points in electronic trading on January 21st, the rookies at the Fed panicked...and sliced 75-basis points off the Fed funds rate to 3.50%, the largest single rate cut in 23 years.

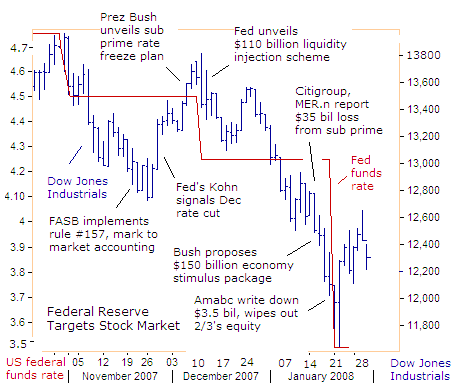

The Fed's emergency rate cut to 3.50% bolstered suspicions that Bernanke is following the blueprints of former Fed chief "Easy" Al Greenspan, pursuing a radical policy of "Asset Targeting" – or adjusting interest rates in the same direction as home prices and the stock market.

But so far, the Fed's 225 basis points of monetary morphine, (the "Bernanke Put") haven't eased the pain in the stock market. Instead, they have been as effective as "pushing on a piece of string".

Gold vs. the PPT: Greenspan's Blueprint for Asset Targeting

In his last speech before the world's central bankers in Jackson Hole, Wyoming on August 28, 2005, Alan Greenspan said dealing with the end of the US housing boom would be the most immediate challenge for his successor.

"The housing boom will inevitably simmer down. As part of that process, house turnover will decline from currently historic levels, while home-price increases will slow and prices could even decrease. Consumer spending will weaken as homeowners slow the pace at which they use home-equity loans to finance expenditure," Greenspan predicted

Thus "Fed policy will be increasingly driven by the configuration of asset prices, which are already an integral part of our evaluation of the large array of forces that influence financial stability and economic growth. But given our current state of knowledge, I find it difficult to envision central banks successfully targeting asset-price changes, such as rises or declines in prices of stocks and houses."

The Fed focuses on so-called wealth effects, or how changes in stock and housing markets may impact business and consumer spending.

On 11th Jan. 2006, New York Fed chief Timothy Geithner laid out the central bank's strategy:

"Once asset prices have changed, the Fed should respond. When policy makers have already witnessed a significant move in asset values, and are confident in what that move means for output and inflation, it should be prepared to adjust policy accordingly," he said.

"The behavior of asset prices will play an important role in the formulation of monetary policy going forward, perhaps more important than in the past."

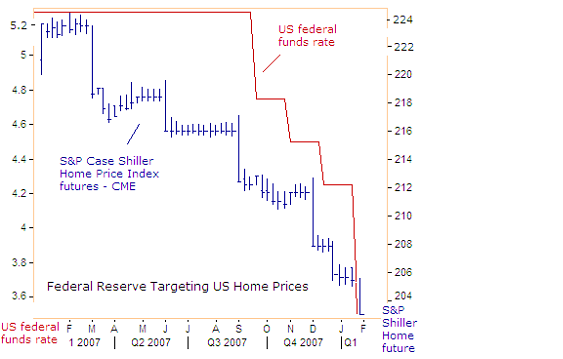

But Robert Shiller, a Yale University economist, and co-founder of the CME's house-price index, predicted on 31 Dec. '07 a possibility that the US economy would stumble into a Japanese-style recession, with house prices declining for years.

"American real estate values have already lost around $1 trillion. That could easily increase threefold over the next few years. This is a much bigger issue than sub-prime. We are talking trillions of dollars' worth of losses," he predicted.

Chicago futures markets are pricing in further declines in US home prices, of up to 16%. In the third quarter of 2007, US homeowners withdrew $20 billion less in equity from their homes than in the prior quarter, and since housing prices have continued to tumble, and the outlook for cash-outs has continued to dim.

Gold vs. the PPT: Bernanke Exercises the "Greenspan Put"

"Easy" Al Greenspan had one formula for rescue operations during times of financial distress.

From the stock market crash of 1987 to the S&L crisis of the early 1990s, and on to the Asian crisis and the collapse of LTCM...right through to the feared Y2K crisis, to the bursting of the tech stock bubble...Greenspan responded with massive doses of monetary morphine to bailout over-zealous speculators in the stock market.

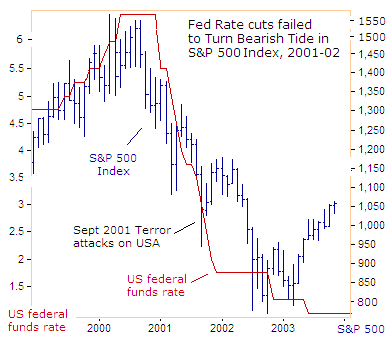

However, the exercise of the "Greenspan Put" ultimately failed to turn the bearish tide in the S&P 500 in 2001-02. The index lost half of its value from its peak in March 2000.

Markets do not travel in straight lines, and the two-year bear market was interrupted by several powerful bargain-hunting rallies, linked to Fed rate cuts. But the rallies eventually fizzled out before the market plunged to new lows.

The outgrowth of the "Greenspan Put", however, was to stimulate bubbles in other markets, such as the housing bubble of 2001-05, engineered by suppressing interest rates at 1% and providing the liquidity needed to reduce investors' fear by creating the expectations that the Fed will always bail them out.

US home prices eventually climbed by 54% to an average $219,000 in June 2005. Greenspan fueled this bubble to pull the US economy out of a mild recession, a tactic first developed – and with great short-term success – by the Bank of England in London.

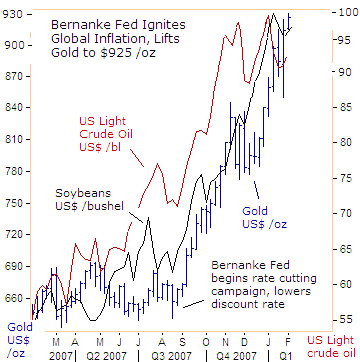

But Greenspan also ignited the "Commodity Super Cycle," which Bernanke then guided to all-time highs this month. Gold Prices continue to rise on the tide of cheap money, and oil is holding above $90 per barrel, more than four times higher from 2001.

Gold vs. the PPT: Housing Bubble Bursts

The housing market became the main driver of the US economy, accounting for half of overall growth and payroll jobs created from 2001 until 2005. Home price appreciation added $5.2 trillion to Americans' balance sheets during the bubble years, or 68% of all wealth creation.

However, now that US home prices are projected to fall by double-digits in 2008, the Fed is exercising the "Bernanke Put".

Last week, Stephen Roach, the head of Morgan Stanley Asia observed, "Policy-makers are reaching back to the same play book that created this mess in the first place. They're saying we are there to clean up after bubbles burst, rather than to prevent them.

"It's a dangerous, reckless and irresponsible way to run the world's largest economy. We have a market-friendly Fed injecting a lot of liquidity in the system which will set us up for another bubble economy. Excessive monetary accommodation just takes us from bubble to bubble to bubble," he explained.

Today, several bubbles are showing up in the food, energy, and precious metals, with the Gold Market trading at a record $930 per ounce.

US consumer prices were 4.1% higher last year, the largest annual rise since 1990, and producer prices were 6.3% higher, just below a 34-year high.

Yet the Bernanke Fed, behaving in a state of panic – and slashing interest rates at a time when inflationary pressures are dangerously high, thus playing Russian roulette with the greenback – is guiding the US economy into the "Stagflation" trap.

On 2nd Oct. 2007, "Easy" Al Greenspan – the godfather of the $1.8 trillion sub-prime debt bubble – warned: "We're beginning to see the extraordinary period of disinflation and economic growth coming to a halt. We now have to be very sensitive to the fact that inflationary pressures could well get out of hand."

Earlier, in an interview in the Dutch newspaper NRC Handelsblad on Sept. 17th, Greenspan warned inflation will rise to about 5% in Europe and the United States. "The normal inflation level is closer to 5% than the current 2 percent," Greenspan said, adding that the 5% level fitted an economy with a "paper" standard where the currency is not linked to Gold Bullion.

The Bernanke Fed's embrace of "Asset Targeting," and its complete disregard for the inflationary consequences of its actions, carries many dangerous side effects, such as the possibility of a crisis of confidence in the US Dollar. On Dec 27th, Hu Xiaolian, director of China's Foreign Exchange warned:

"If the US Federal funds rate continues to fall, this will certainly have a harmful effect on the US Dollar exchange rate and the international currency system."

Bernanke is risking a disastrous replay of the 1970's, when high oil prices fueled double-digit inflation. Every time the Fed lowered rates to boost job growth, inflation took off, causing a vicious price spiral. The Fed let the disease rage for so long that it took a strict monetarist approach by Paul Volcker in the early 1980's to finally defeat inflation. The price was a deep recession, with unemployment hitting 11% in 1982.

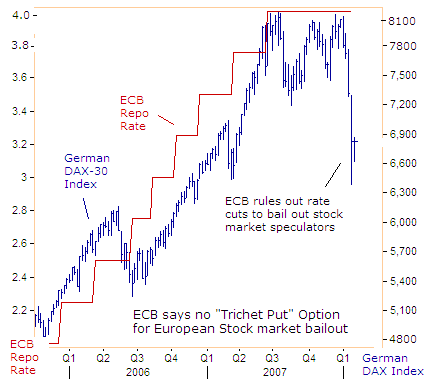

Gold vs. PPT: ECB Shifts from Policy of "Asset Targeting"

Hopes that the Fed's emergency rate cuts to 3.00% would be followed by an easier European Central Bank policy were dashed last week, when ECB chief Jean "Tricky" Trichet said he would not cut Euro zone interest rates in line with the meltdown in European stock markets.

For many years, the ECB had been targeting its main "repo" rate in line with the direction of European stock markets, while allowing the Euro to climb higher against the US Dollar to help contain the cost of raw materials.

After the benchmark German DAX Index plunged by roughly 15% last week, in reaction to meltdowns in Asia and Wall Street [Ed: as well SocGen closing out Jerome Kerviel's losing trades...], European stock market speculators were hoping for the instant exercise of the "Trichet Put" to bail them out of a tough situation.

Instead, "Tricky" Trichet signaled a hard-line stance in sharp contrast to the rookies at the Bernanke Fed, saying he is focused on fighting inflation, even in the face of a big stock market meltdown.

"In demanding times of significant market correction and turbulences, it is the responsibility of the ECB to solidly anchor inflation expectations to avoid additional volatility in already highly volatile markets. At this stage I think we have to look at what's happening in the real economy, we have a base scenario and at this stage I'm not going to modify this base scenario," Trichet said.

"There is one needle in our compass and it is price stability. There is no contradiction between price stability and financial stability. The market correction, which the ECB and other central banks had warned over a year go, was now taking place and it is significant.

"But under the capital market system it was natural for risks to emerge and central banks' main job [is] to solidly anchor inflation expectations.

"What is extremely important is to offer a steady hand as possible. First, price stability and then solidly anchor inflation expectations. If risks did not materialize you would not be living in a market economy, you would be living in the Soviet Union," as Trichet explained on Jan 24th. He was backed up by the Bundesbank's Juergen Stark on Jan 22nd:

"Our main worry is the high inflation rate of 3.1% in the Eurozone. Volatility on global stock markets is not helpful, but recent developments are an overreaction and their importance should not be exaggerated."

On Jan 28th, Austrian Chancellor Alfred Gusenbauer said what was right for the US was not necessarily right for Europe. "You can't just go and say, we'll do the same thing as the Fed. Despite the pressure, we shouldn't cut interest rates and we ought to get towards an inflation rate of around 2% in the Euro zone," he said.

In short, we're witnessing the reincarnation of the old "Tricky" Trichet, harkening back to a speech he gave on April 23, 2002 to the Federal Reserve Bank of Chicago and the World Bank. Then, Bank of France chief Trichet warned that central bankers must be cautious in considering volatile asset prices such as the stock market and housing prices when setting monetary policy

"My feeling is that we should remain extremely cautious about it, because it would be like opening Pandora's Box if we started setting our key policy rates according to asset price changes. Not only could the large swings, misalignments or even bubbles of assets prices endanger price stability, which is the main objective of most central banks, but also they could impinge upon financial stability," he warned.

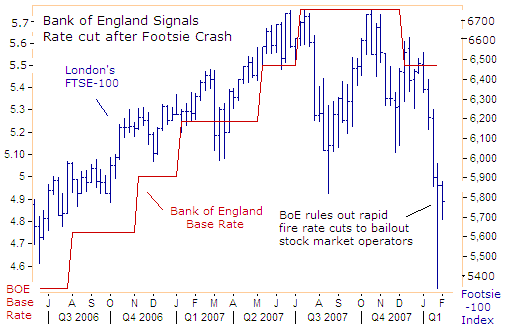

Gold vs. PPT: Bank of England Sits in the Middle of the Road

The Bank of England is a disciple of "Asset Targeting", and nowadays British interest rates are largely moved by the direction of UK home prices.

On Nov 23rd, the BoE's Rachel Lomax indicated the central bank faces a tricky balancing act, saying that "while current stock market woes could hit British property prices, there are always risks in easing policy at a time of rising energy prices.

"This is all the more so after a year when inflation measures remains uncomfortably high. On the other hand, we need to be very alert to the risk that the economy may be slowing too abruptly. At current interest rate levels monetary policy may be on the restrictive side."

Two weeks later, the BoE lowered its base rate a quarter-point to 5.50%, the first rate cut in over two years. Just like the dip in rates of late 2005, it was designed to shore-up the UK housing market in the face of a global credit crunch.

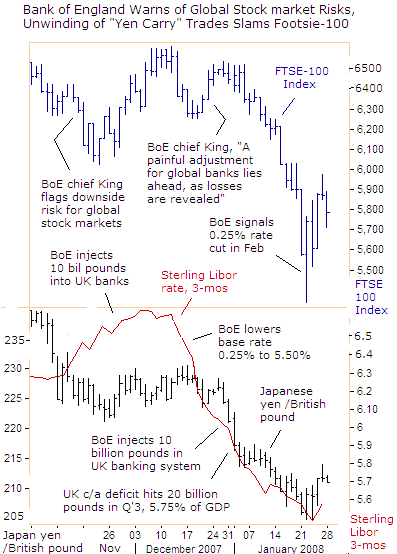

Interestingly enough, BoE chief King issued two warnings of an impending global stock market crash in November and in December, mostly ignored by over zealous stock market operators until a panic sell-off hit in January.

"The re-pricing of risk we have talked about for some considerable time hasn't really fed through to markets such as equity markets, and if there were to be an adjustment of risk premiums in equity markets, with a fall in asset prices, then that could have a bigger impact on the world economy," King warned on Nov 14th.

"It's very striking that despite developments we've seen in the last three months, equity prices are on average higher now than they were in August. This is true around the world and in emerging markets, they're 20% higher. There must be some downside risks there."

On Dec 18th, Mr. King warned of more bad news to come for the financial sector. "The problems in the financial sector remain with us," he told the UK's parliament's Treasury Select Committee.

"A painful adjustment faces the global banking sector over the next few months as losses are revealed and new capital is raised to repair bank balance sheets. Banks' reluctance to lend will lead to a sharper slowdown in the United States. That concern is a serious one because it does hold out the prospect that there will be a self-reinforcing downturn in credit and activity."

The BoE has since hinted at another quarter-point rate cut to 5.25% in February to safeguard home prices, but aggressive cuts of the kind initiated by the rookies at the Bernanke Fed are not on the cards.

BoE chief Mervyn King said this week Britain's economy faces its most challenging year in a decade, but suggested that rapid-fire interest rate cuts were not the answer to financial market woes.

Yet on Jan 28th, the BoE's radical inflationist, US academic David Blanchflower, said in an interview with The Guardian newspaper that the current level of UK interest rates at 5.50% was too restrictive.

"Worrying about inflation at this time seems like fiddling when Rome burns. There are risks to the upside to inflation, but the greater risks are to activity on the downside. Evidence from the housing market and especially the commercial property market is worrying," he said.

BoE hawk Andrew Sentance, in contrast, warned that market expectations of several more rate cuts were ignoring rising price pressures, and BoE chief Mervyn King pointed to a balanced approach between slowing growth and rising inflation.

"Although central banks can and will respond to the consequences of strains in the banking system, the solution to the underlying problem does not rest with them, but with the banks and financial markets themselves," King said on Jan 23rd.

Gold vs. PPT: Bursting of Shanghai Red-chip Bubble?

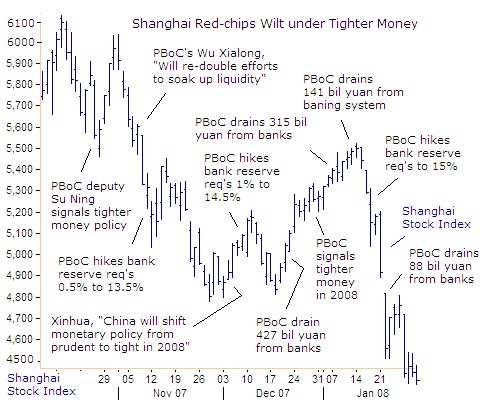

While the Bernanke Fed is slashing interest rates at a frantic pace, and the Europeans hold a steady line, the Chinese central bank is moving in the opposite direction, and tightening liquidity in the Shanghai money markets.

On Monday this week, the mighty Shanghai red-chip index plunged 7.2% to 4,435 – its fourth biggest drop this decade. That left it 28% below its record intra-day high, hit back in October.

China's central bank has poured cold water on the idea that the country's juggernaut economy can decouple from the United States. "China's exports will be badly hit if US consumption weakens," says Zhang Tao, of the People's Bank of China.

"If US consumption really comes down, that's bad news for us. That will have a pretty severe impact on our exports."

On Jan 4th, China's central bank vowed to further tighten monetary policy in 2008, aiming to prevent inflation from spreading across the broader economy. With food accounting for a third of China's consumer price basket, the 18% surge in Chinese food prices last year is a ticking time bomb, where fuel price increases touch off violent protests.

If the inflation problem gets out of hand, it could have devastating implications for the economy, and China's political stability.

The Shanghai Composite Index has now closed at a fresh five-month low below key support at 4,400, leaving it 28% below its record intra-day high of Oct. The nation's biggest lender, Industrial & Commercial Bank of China, dropped 6.2% on Monday while brokerage industry leader CITIC Securities plunged 10%, suggesting pessimism about the market's prospects.

So while the Bernanke Fed tries to re-inflate the US stock markets with massive dosages of morphine, he is can't rig the foreign stock markets, which are starting to trend lower, and like a row of dominoes, the tremors might be felt on Wall Street in the months ahead.

To stay on top of volatile markets, subscribe to the Global Money Trends newsletter today for insightful analysis and predictions of the future for:

- the top stock markets around the world

- commodities such as crude oil, copper, gold, silver, and related gold mining and oil company indexes

- foreign currencies, interest rates, global bond markets and central bank monetary policies

GMT filters important news and information into bullet-point, easy to understand detail, featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world.

Subscribers to GMT can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio for Q'1, 2008.

Email us

Email us