Gold 'A Pure USA Hedge' for Central Banks Ahead of Fed Rate Cut

GOLD and SILVER PRICES traded flat on Monday as the US Dollar rallied from 1-month lows against other major currencies ahead of this week's decision on interest rates from US central bank the Federal Reserve, writes Atsuko Whitehouse at BullionVault.

New data said a raft of central banks continued to buy gold in November, even as the 'safe haven' precious metal set new month-average record prices in terms of all major currencies.

"Gold is seen as a pure USA hedge," says Nicky Shiels, head of metals strategy at Swiss bullion refiner and finance group MKS Pamp, repeating the "anti-Dollar" appeal of gold in 2025 and noting that some central banks may report only the bare minimum about their purchases for fear of reprisal from the US administration.

"Fed easing and a weaker US Dollar create a dual tailwind for gold, both directly through lower real yields and via denomination effects," says a note from asset-management giant State Street looking forward to this week's interest-rate decision and saying that $5000 gold is "definitely maybe" for 2026.

The odds of a December rate cut at Wednesday's meeting − seen as a 2-in-3 chance this time last month – have now risen to almost 9-in-10, according to positioning in interest-rate futures tracked by derivatives exchange the CME.

After making its 4th consecutive weekly gain to hit a new week-end gold record at London's 3pm auction on Friday, the 'safe haven' precious metal reversed an earlier rise on Monday to trade back around the $4200 level at lunchtime.

The price of silver, which now finds nearly 60% of annual demand from industrial uses, also moved sideways, trading $1 below Friday's new all-time record peak above $59 per ounce.

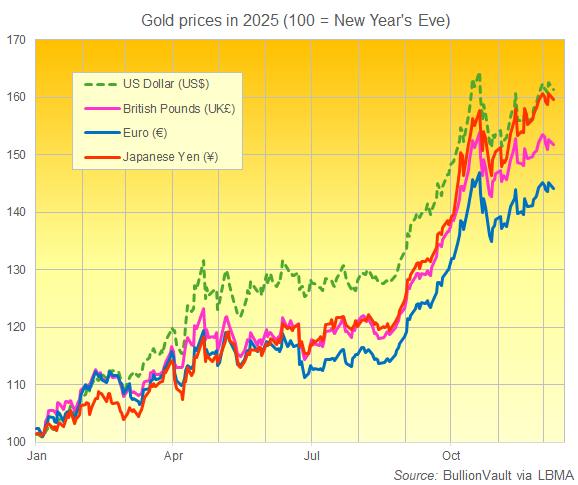

Gold priced in the US Dollar has risen 60.4% so far in 2025, the strongest annual performance for gold's rise against other major currencies.

That figure is followed by gold gains of 58.8% in the Japanese Yen, 51.1% in the UK Pound, and 43.5% in the Euro.

Silver in the US Dollar has meanwhile risen 102.3% so far this year, also the strongest annual gain since 1979.

Gains for UK, European and Japanese investors have reached 90.4%, 80.7%, and 100.1%, respectively.

Official data today said that November saw continued gold buying by the central banks of China, Poland, Brazil and Uzbekistan.

The People's Bank of China made its 13th consecutive monthly purchase (albeit of only 1 tonne for the 3rd month in a row), while Narodowy Bank Polski accelerated its 2025-to-date accumulation to 96 tonnes, and Banco Central do Brasil reported buying another 11 tonnes on top of the 16 tonnes of gold it bought in each of October and September, its first official purchases in 4 years.

With central banks widely seen easing back from gold buying this fall, "ETF investors have been a price maker over the past four to six months, rather than a price taker," says Rhona O'Connell at brokerage StoneX Group Inc.

Globally, gold exchange-traded trust funds − often used by institutional and private investors for gold-price exposure without ownership − saw their 6th consecutive month of net inflows in November, adding $5.2 billion in value and 38.5 tonnes in weight, according to the latest monthly data compiled by the mining industry's World Gold Council (WGC).

Gold ETFs' total AUM continued to surge, reaching another month-end peak, with holdings also climbing to the highest month-end level in history, the WGC added.

Giant gold ETF the GLD grew 0.5% in the first week of December, recovering to its highest level since mid-October's record-high gold price peak.

No.2 gold ETF the IAU last week expanded by 0.4%, also reaching its highest level in 1.5 months.

Like gold and silver prices on Monday, global stock markets held flat near last month's new record highs on the MSCI World Index.

The US Dollar Index – a measure of the US currency's value versus its major peers – rose slightly after testing its weakest level since the end of October ahead of Wednesday's final US Fed decision of the year.

Email us

Email us