Gold ETF Surge Sends Price Just 1% off $4000 with Fastest Jump Since the 1970s

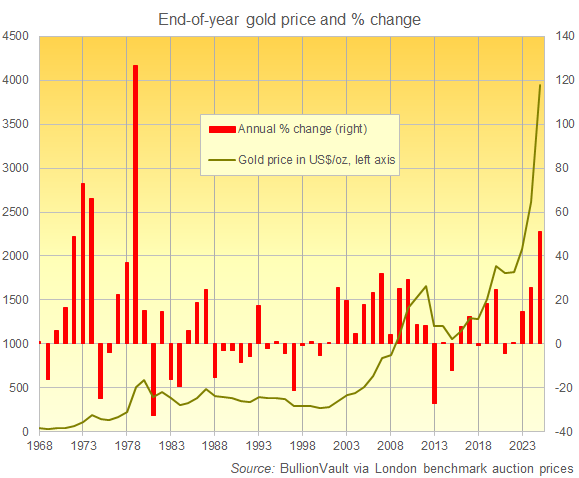

The GOLD PRICE surged to fresh all-time highs barely 1% off $4000 per ounce on Monday, lifting its year-to-date gain past 50% − the strongest annual rise outside the 1970s' oil crises − as political turmoil in the US, Japan and France continued amid strong investment inflows to gold-backed ETF trust funds, writes Atsuko Whitehouse at BullionVault.

Spot gold priced in US Dollars surged as much as 1.8% to an all-time high of $3958 per ounce, while wholesale bullion for UK and European investors earlier jumped as much as 2.0% and 2.5% to highs of £2942 and €3387 respectively.

Gold in Japanese Yen climbed 3.5% to a new spot-market record of ¥19,078 per gram, pushing the retail price including consumption tax above ¥21,000 for the first time.

Today's surge followed gold's 5th consecutive weekend record in a row, and set the 41st new daily high this year.

The 'safe haven' yellow metal is currently showing a year-to-date gain of more than 50%, the biggest annual rise since the 1979 oil shock.

"Gold rallies can continue into 2026 aided by official sector buying," says bullion-bank and ETF storage provider HSBC in a note.

"Institutional demand for gold as a [portfolio] diversifier can stay robust" too, it adds.

With gold prices approaching $4000, London bullion clearer UBS has raised its gold and silver price forecasts to $4200 per ounce and $55 per ounce by mid-2026, with the Swiss bank's strategists saying the revisions reflect expectations of stronger central bank and ETF demand.

US investment bank Goldman Sachs has already predicted that gold would soar to nearly $5000 per ounce if just 1% of privately-held US Treasury holdings go into gold, saying the move would be exacerbated if investment flows into gold ETFs continue to jump.

Total gold ETF holdings worldwide stood above 3,806 tonnes as of 26th September, according to data from the mining industry's World Gold Council data, worth a record $461.5 billion but still 3.1% below the peak by weight hit at the height of the Covid crisis in November 2020.

The divided US Senate will vote Monday on a stopgap bill to reopen the government through 21st November, after shutdowns since 1st October delayed key economic data, including Friday's non-farm payrolls and derivatives regulator the CFTC's weekly gold and other commodity positioning reports.

"I think that if the President decides that the negotiations are absolutely going nowhere that there will start to be layoffs," said Kevin Hassett, Trump's top economic adviser in the White House, on Sunday.

Japan's ruling party meantime selected fiscal and monetary 'dove' Sanae Takaichi as the LDP's new leader, setting her on course to become the country's first female prime minister later this month.

Japanese stock markets today surged over 5.0% to a record high, while the Yen fell past ¥150 per US Dollar, and 30-year government bond yields hit a historic peak amid worsening fiscal concerns.

France is also due a new prime minister after Sébastien Lecornu resigned less than a month after being appointed, spurring a 2.0% plunge in Paris' Cac 40 stock index and pushing up the spread of France's 10-year borrowing costs over German Bunds to 0.88 points − its highest since the Eurozone debt crisis more than a decade ago.

With gold jumping on the latest ETF inflows, prices for silver − which finds nearly 60% of its annual demand from industrial uses − rose as much as 1.6% to $48.75 per ounce in earlier trading on Monday, barely $1 off the all-time high of $50 hit in 1980 and 2011.

The grey metal has now risen 67.9% year-to-date.

Israel and Hamas were meanwhile set to begin mediated negotiations in Egypt on Monday after US President Trump gave the Gaza political and military group a Sunday deadline to accept his peace plan or face "all hell".

Email us

Email us