Return to Flash Mountain

The unexpected consequences of US credit going bye-bye...

The TOXIC TENTACLES of recession seem to extend into every imaginable – and unimaginable – pocket of the economy, writes Eric Fry in the Rude Awakening.

As these tentacles release their toxins, the resulting distress affects both individuals and industries alike, often in ways we might not have imagined in advance. But so too do recessions impart the occasional surprising benefit.

Our advice? Enjoy the benefits when and where you can because this recession is likely to get much worse before it gets better.

"Call it an unexpected consequence of the bad economy," the LA Times remarks. "A recent round of staff reductions at Disneyland could result in the return of embarrassing episodes of public nudity at the Happiest Place on Earth.

"Back in 1997, a front-page story in the Los Angeles Times chronicled a scintillating internet phenomenon involving the Anaheim theme park's Splash Mountain log ride: Photos of women flashing their breasts at an automatic camera that snapped souvenir photographs during the final 50-foot drop were 'unzip-a-dee-doo-dahing' their way around cyberspace, earning the ride the dubious nickname 'Flash Mountain'."

Disneyland officials quickly put a stop to this informal soft porn by hiring employees to examine each and every photo before posting them on the preview screens at the end of the ride.

But alas, declining revenues at Disney's theme parks have forced a variety of cost-cutting measures. The photo screeners at Splash Mountain, Tower of Terror, and California Screamin' have been redeployed to other positions.

"Actual inappropriate behaviors [sic] by guests are rare," a Disney spokesperson explained. But more correctly, "Inappropriate behaviors" WERE rare. Now that the breast police have been re-assigned, "inappropriate behaviors" are likely to increase.

This serendipitous recessionary "benefit" is probably not sufficient to boost Disney's ticket sales, however. A family of four must spend at least $356 for a one-day visit to Disneyland here in Southern California, and that's before paying for parking, food, Mickey Mouse ears, or a souvenir photo of mom riding Splash Mountain.

That's a large chunk of change, even for those folks who still have a job and a little bit of money in the bank.

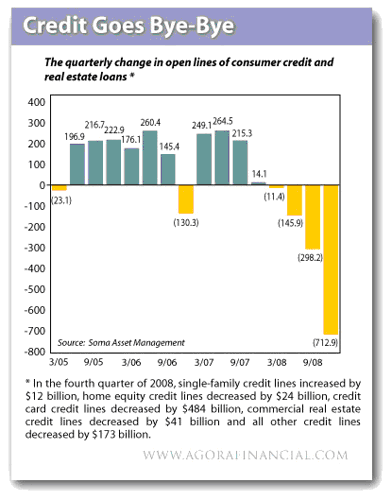

Therefore, the fact that unemployment is rising – in a populace with meager savings and plummeting home values – is a fact that provides little hope the economy is genuinely improving. Furthermore, the theoretically recovering banking sector is engineering its "recovery" by shrinking the asset side of its balance sheet. The banking sector is rapidly withdrawing credit from almost every sector of the economy – especially the consumer sector. That's an ominous development for an economy that is as dependant upon credit as the American economy.

To validate the contention that sources of credit are disappearing, we offer both anecdote and hard data. First the anecdote...

"I talked to my 22-year old son last night," a friend of your editor's related recently. "Wells Fargo was his company's only high-quality finance company for people buying air conditioning systems for their homes. Last week, Wells cancelled their vendor lending program for all of Texas. Credit rejections used to run at 20% of applications for my son's company. Now they are running at 40%-plus. Bottom line – one of our TARP recipients has stopped lending to real people with jobs and 'good credit' who want to buy domestically manufactured and installed assets to improve their homes."

Now, the hard data...

At the recent Value Investing Congress in Pasadena, California, hedge fund manager Igor Lotsvin, offered the following observations:

"The results of this banking crisis – and we do think very much that the worst is ahead of us – is that the banks are not lending. We see this almost everywhere and in every way... the banks have cut their unused lines of credit commitments by $1 trillion in the last six months of last year. That basically means lines of credit and credit cards. In the fourth quarter of 2008 alone, banks have cut more than half a trillion Dollars of consumer lines of credit.

"So think about the American consumers; they are basically in the situation where their 401(k) got cut in half, where their house is worth 30% less than it was three years ago... and now their only source of liquidity is their credit card. And that's being cut off very rapidly...

"The de-leveraging that's taking place in the world is continuing a very massive scale. The world is really on the margin call right now and it will not cure itself in the next couple of quarters. There is plenty of more pain to come."

In order to see the beginning of a recovery, says Lotsvin, we would have to see the beginning of banks' willingness to lend. But that's not happening.

"The banks have been pumped with hundreds of billions of Dollars of liquidity and trillions of Dollars worth of guarantees," says Lotsvin. "We don't see any lending. Lending is not happening, so the government can't force banks to lend without taking ownership in them... you don't see JP Morgan lending, you don't see Citigroup lending, you don't see it Wells Fargo lending...So that is not happening.

"Our premise is the economy will not work until you restore the credit pulse."

Which seems like a plausible premise.

Email us

Email us