House Prices in Gold below Depression Era Levels

Ignore those predicting a housing bust. Gold shows us it's already happening...

WHEN IS a Dollar not a Dollar? asks Charles Vollum of Casey Research.

When it's been tied up in housing for nine years.

On June 3, Standard and Poor's issued the latest update to its Case-Shiller Home Price series, writes

The press release begins, "Data through March 2011 ... show that the US National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter's data and posted an annual decline of 5.1% versus the first quarter of 2010."

Then comes the key statement: "Nationally, home prices are back to their mid-2002 levels."

This means that on the average, a home in the US that was purchased for $200,000 in mid-2002 would have sold for about the same price two months ago. So after owning the home for almost nine years, you could sell it and break even – no capital gain nor loss, and all of the cash you originally invested would be returned to you.

But the Dollars returned are not the same Dollars that were invested!

The US Dollar of mid-2002 could buy a lot more than the spring 2011 model... A barrel of crude oil cost $27 then, but about $100 now. A gallon of gasoline was $1.43 then, but $3.90 now. To purchase a shopping basket of food totaling $88 in mid-2002 would now ring the register for $232. An ounce of gold was around $315 back then, but over $1,400 at the end of Q1 2011!

So that house may have the same Dollar price, but it does not have the same value.

The price distortions caused by a depreciating currency play havoc with investors' efforts to decide what price to pay for assets, as well as making it difficult to tell when to sell. After all, our goal isn't just to build an account with big numbers in it – we want to be able to afford a better life for ourselves and our families.

One approach to solving this problem is to price things using a more stable form of money – one that cannot be created and destroyed at the whim of a central bank. Gold.

In July of 2002, one Dollar would buy 100 mg of gold – a penny was a milligram. In March of 2011, one Dollar bought only 22 mg of gold – and at the end of May, just 20 mg. Some things are more expensive today in gold terms, but many are not.

For instance, it takes less gold to buy a barrel of crude today than in 2002 (2.0 grams instead of 2.7 grams), but it takes a bit more gold to buy a pound of coffee (54 mg instead of 50 mg).

And yet, both coffee and crude oil are several times more expensive in Dollars than they were nine years ago. The same goes for silver, food, copper, gasoline, postage, college tuition... almost anything you can think of.

Except houses.

Using gold as the standard of measure shows what is really happening with home values:

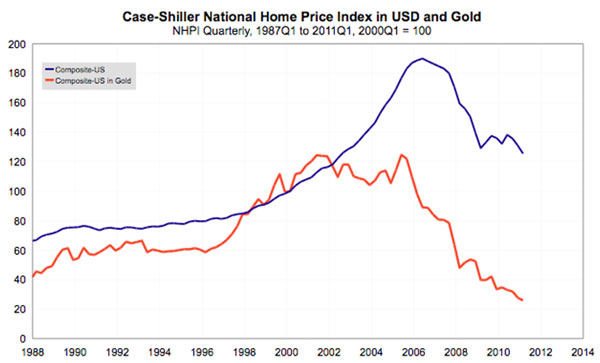

The blue line shows house prices in Dollars, the red shows them in terms of gold.

Home values haven't just rolled back to their 2002 levels – they have been making new all-time lows every quarter for the last year!

This chart by itself can't tell you whether it is time to buy a house, or if it is too late to sell that second home. Prices could keep falling, or they could stabilize and begin to recover; that will be determined by the supply of homes on the market, the needs of buyers, and the strength of their finances.

One thing is certain: in the aggregate, home values will never go to zero. People need to live somewhere, and real property has real value. But in the coming months, the Dollar price of housing may stabilize, and even rise if QE3 is launched or massive amounts of new fiat money are created to bail out Europe or to contain some other emerging crisis – even as real values are stagnant or falling. Take a look at 2001-2006 and 2009-2011 in the chart above for examples of this.

Yet the Home Price Index only goes back to 1987... Just how low are home prices compared to the decades before these records began?

US Census Bureau data show that in 1963 the median price for a new home was $17,200, or 15.2 kg of gold. In April of 2011, the median new home price was $217,900, or 4.4 kg of gold – 71% less than in 1963!

But let's peer back even further, to the cyclical low of the last century – the Great Depression.

Comparing today's prices to those of the 1930s is a bit harder, as back then most houses were smaller and lacked many of the features we now take for granted. According to The People History, in 1930 the average new home sold for $7,145 or 11.1 kg. By 1935, at the bottom of the Great Depression, the price of a new home had fallen to $3,450 or 3.1 kg – 30% less than the April 2011 price.

However, in the 1930s, the size of an average home was around 1,000 ft2, while today's average home is about 2,169 ft2. So homes now cost about 2 grams/ft2 – 35% less than the 1935 cost of 3.1 grams/ft2. This is even more amazing when one considers that today's homes include central heating and air conditioning, vastly improved insulation, and many other features and conveniences not found in a typical 1930s home.

So home prices today are not just the lowest in the last 25 years, they are actually lower than at the bottom of the Great Depression!

The Greater Depression isn't just a possible future that we might encounter – we are deep in it right now. The truth about our situation is being masked by the massive quantities of money being created by central banks around the world.

The key to surviving and thriving is to have your savings out of reach of the government currency manipulators by keeping it in gold, and to ensure that your investments are growing in gold value, not just showing illusory funny-money gains.

Looking to protect your wealth by Buying Gold?...

Email us

Email us