Commodities 2023 Review and Outlook

Each new American needs 3 million pounds of resources...

The UNITED STATES is adding new renewable energy capacity at a record clip, but that doesn't mean it's ready to quit fossil fuels just yet, writes Frank Holmes at US Global Investors.

The country just became the world's biggest exporter of liquefied natural gas (LNG) for the first time ever, with last year's shipments hitting an unprecedented 91.2 million metric tonnes, exceeding top suppliers Australia and Qatar.

The surge in LNG exports, primarily driven by Freeport LNG's return to full service and robust global demand, particularly from Europe, signifies America's pivotal role in the global energy market.

The US also remains the world's largest oil producer. In October, the energy powerhouse generated a staggering 13.25 million barrels per day, marking only the fourth month on record that the country met or surpassed 13 million barrels per day on average.

It's against this backdrop that we share with you our always-popular, interactive Periodic Table of Commodities Returns, updated to reflect 2023 data.

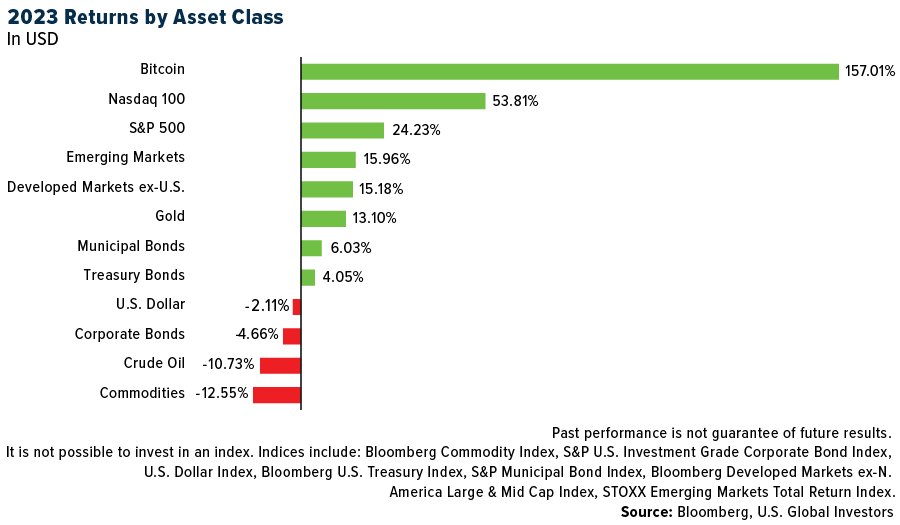

Commodities as a whole had a challenging year, with the group finishing down 12.55% due to a number of factors, including rising rates, recession fears and China's disappointing pandemic reopening.

Excess supply contributed to the drawdown. Despite strong global demand, the price of natural gas plunged nearly 44%, its worst year in at least a decade, largely as a result of record-high production. According to the Energy Information Administration (EIA), the US produced an astonishing 104.9 billion cubic feet per (Bcf/d), a new monthly high.

After topping the list of commodities in the previous two years, lithium prices cratered for very much the same reason in 2023. This, combined with news that Americans' appetite for electric vehicles (EVs) may be waning, drove the battery metal down to prices last seen in summer 2021.

I believe these lower prices set up an attractive buying opportunity. Commodities are the building blocks of everything we use and enjoy on a daily basis, and as the global population expands, so too does demand for these materials.

The Minerals Education Coalition (MEC) estimates that every American born in 2023 will require over 3 million pounds of metals, minerals and fuels over the course of their lifetime. Last year alone, over 40,000 pounds of raw materials, from cement to sand to aluminum, were needed for every person in the US.

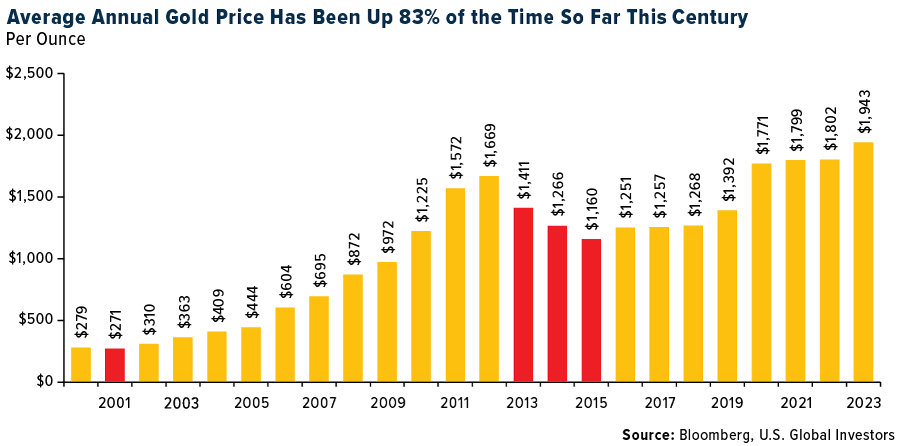

Gold was the number one commodity and only one of two that finished the year in the black, copper being the other commodity (just barely). The precious metal rose 13.10% to close the year above $2,000 per ounce for the very first time, and with an average 2023 price of $1,943, it managed to notch its eighth straight annual gain. Gold has now advanced in 20 of the past 24 years, or 83% of the time.

Looking ahead to the end of 2024, I believe we'll see a fresh boost in gold's investment case once the Federal Reserve begins trimming rates.

Support should also come from central banks, which bought a record amount of gold in the first nine months of the year. Financial institutions purchased a net 800 metric tonnes from January to September 2023, a 14% increase from the same period in 2022, according to the World Gold Council (WGC).

China easily led all other countries, accumulating 181 tonnes of gold in the first nine months, as it seeks to prop up its currency and diversify away from the US Dollar. The WGC estimates that gold now represents just 4.3% of the country's total foreign reserves, compared to nearly 70% for the US If China were to get to America's level, it would need to buy an additional 33,810 metric tonnes, which is 10 times more gold than the entire world produced in 2022.

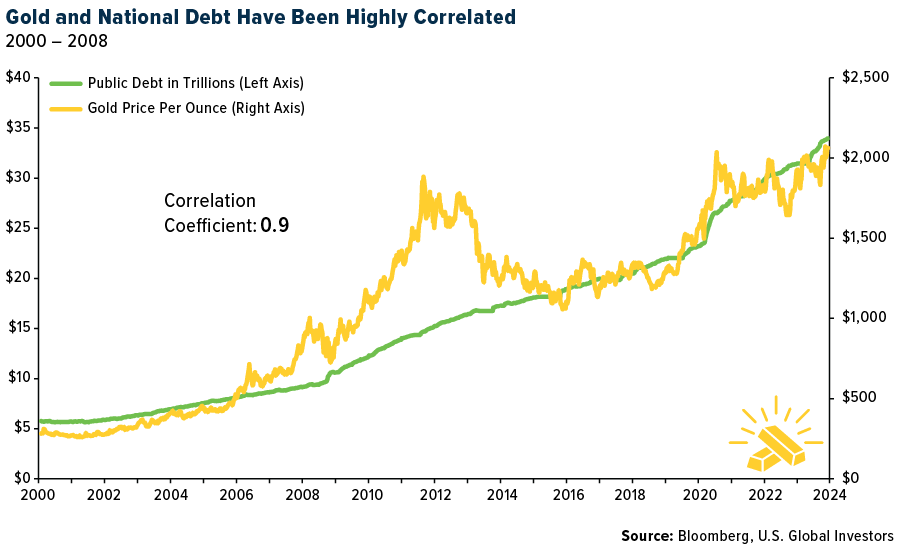

Before moving on, I'd like to point out that US national debt just crossed above $34 trillion for the first time, the equivalent of $101,000 per US citizen, or $264,000 per taxpayer. I believe this is a good place to look if you want to know where gold may be headed in the coming months and years.

Since the start of this century, national debt and gold have shared a strong positive correlation coefficient of 0.9. In simple terms, this means that both have tended to make similar moves day-to-day. If you think debt is headed higher, it may make sense to consider an investment in physical gold and gold mining stocks.

On the energy side, the renewable energy market saw significant strides in 2023, with over 440 gigawatts of added capacity. Notably, both the US and Europe set new benchmarks for solar installations, while China's contributions dwarfed everyone else's, adding between 180 and 230 gigawatts (GW).

Wood Mackenzie, however, forecasts a slowdown in the growth rate of annual solar installations this year. Despite this, the global solar market remains substantially larger than it was a few years ago, following a typical S-curve pattern of rapid growth followed by gradual maturation. This build-out is expected to benefit silver in particular, a key mineral found in photovoltaic (PV) panels.

On a final note, 2024 is an election year, and it appears more and more likely that we'll have a second rematch between incumbent president Joe Biden and Donald Trump. I expect to see heightened vitriol and animus this year compared to past cycles, given that both men are deeply unpopular and facing either criminal charges or an impeachment inquiry.

As unpleasant as this election is shaping up to be, I don't predict substantial effects on the market. Believe it or not, the S&P 500 has never declined in a presidential re-election year, and historical data doesn't support the notion that election outcomes profoundly influence US stock market returns over the long term. Other factors are more crucial in driving stock market trends.

Therefore, I advise that investors concentrate on underlying economic conditions. In an election year, the most effective investment strategy, in my view, is to maintain a diversified portfolio instead of pursuing short-term, tactical bets.

Email us

Email us