Gold Falls as Markets ‘Sceptical’ on Gold’s Upside despite China’s Robust Demand

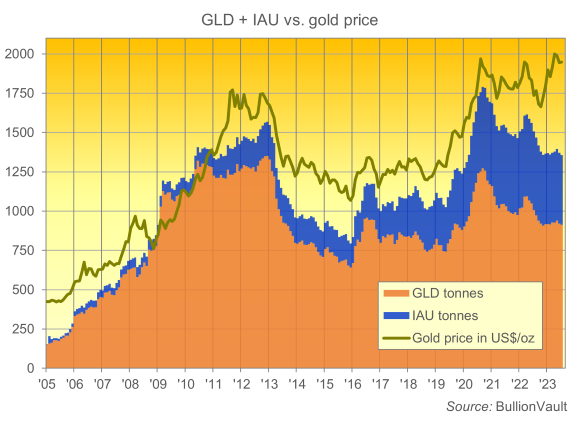

GOLD PRICES reversed most of Friday’s gain on Monday, while markets remain ‘sceptical’ about the upside potential as gold ETFs continue to liquidate and net bullish bets on futures and options declined, although China’s consumer and central bank continued to show robust demand, writes Atsuko Whitehouse at BullionVault.

Email us

Email us