Trade gold

There are many reasons that investors choose to own gold.

It could be part of a portfolio, providing security or hedging against other asset classes.

It could be a long-term position, calculating that gold demand will remain high.

Others trade gold regularly, buying or selling according to their position on the day-to-day and week-to-week fluctuations of the price of gold.

As in any financial market, trading gold for profit means buying gold at low prices, selling them high, and knowing how to spot the difference and time your trades.

Golden rule

Countless books, websites, courses and seminars claim to deliver a gold trading edge or insights into the dynamics of the price of gold. But few will remind you of the first rule of investing for profit, whether it be in the physical gold market, gold futures, stocks, currencies or commodities: make sure your trading costs are as low as possible.

You might buy low and sell high, but if you're trading gold actively, your profits will dwindle if you're paying high brokerage fees every time you trade.

Whether you want to trade gold as a long term investor or as an active trader, we can show you a solution that makes real, high-integrity gold bullion available to you, stored and insured securely in professional vaults. Use this route into the gold market and you'll find that you can both reduce costs and increase the safety of your assets, whatever the price of gold.

Trade gold and earn the spread

To trade gold actively and profitably, first calculate your costs. Fluctuations of gold price may motivate gold trading, but if you're paying commissions and spread on each transaction, you won't be making the most of the gold market.

Unlike any other way to trade gold, BullionVault allows you to undertake active gold trading like a market professional, by quoting prices to others in the market, rather than having to take what's on offer. This allows you to trade gold and earn the spread.

For example, if gold prices are at $1,700, a gold trader might bid to buy $1,699 and offer to sell at $1,701. As a liquidity provider you earn the $2 in the spread. Trading on BullionVault allows anyone who wants to trade gold to become a liquidity provider.

Make money on every gold trade

BullionVault's most active traders pay just 0.05% commission (that's 85 cents on a $1700 ounce) when they trade gold. If they're picking up a $2 spread and paying 85 cents each side, then round-tripping an ounce of gold on a stable $1700 price earns them $0.30. This means that on an unmoving price you can earn money by providing liquidity.

There are very few systems in the world that let participants access the spread. With trading "costs" effectively locked in as profit, this access to the spread means that you can take home all the profits from your trades on the fluctuations in the price of gold, without commission eating into the margins.

Spread access is the first tool that gives you the ability to trade gold and profit, and that's why most businesses and brokers keep it for themselves.

Why BullionVault?

BullionVault is the cheapest, safest, and most accessible worldwide market for gold trading of privately owned bullion. There is no fairer proposition to the gold trader. But please, always be aware that - as in any market - there are risks and swings, and those new to gold trading should carefully research their intended positions.

Ready to find out more about gold prices and to start trading gold? Read more here...

For more about the gold markets and how people can make money out of the precious metal through market movements rather than physical ownership, read on...

Gold as a commodity

Gold has been used as a symbol of wealth and power and as a form of currency for millennia. Physical gold was mined and traded for its utility to individuals and companies manufacturing jewellery and other products, and for nations and rulers minting their own currency.

Trading gold as a commodity was less common - although people who could would still store gold as an insurance against future disasters. This dynamic is still apparent centuries later, as anyone who has tracked the price of gold in times of political or economic turmoil will know.

Gold standards

The creation of gold standards represented one of the most significant developments in the history of gold trading. These were systems in which the value of a country's currency was pegged to the value of gold, with the physical gold stocks held in their exchequer.

In the UK, a version of the gold standard came into force in 1821 and was abandoned in 1931 as the Great Depression threatened the country's gold reserves. The US exited the gold standard in 1971, with President Richard Nixon setting the price of gold on the open market at $35 per ounce.

This marked the beginning of the modern history of gold trading. The precious metal was once again a commodity not a currency. Gold prices were set by supply and demand, and the $35 per ounce valuation receded into the distance.

Modern gold trading

President Franklin Roosevelt's Gold Reserve Act of 1934 had made the ownership of physical gold illegal in the United States. The reversal of this act in 1975 meant gold trading was possible, and with the opening up of gold demand, the price of the commodity soared.

Gold became a popular asset for investors who wished to reduce their risk by diversifying their portfolio outside of traditional stocks and shares. And - as in any modern market - speculators began to trade not just the precious metal itself, but gold futures, options and exchange traded funds (gold ETFs).

When trading derivatives, investors don't necessarily need to hold the traditional "buy low, sell high" metric, as they can go "long" and "short" on gold prices - predicting rises and falls in the price of gold and taking advantage of the market either way.

Predicting the market

The aim of gold trading is always to predict which direction the market will move in. The further the market moves in the direction a gold trader has predicted, the more they profit.

This type of gold trading is seen by some investors as a less volatile, longer-term alternative to currency trading (forex). The principles are the same, but while forex traders will look to exploit short-term price fluctuations, gold traders look to benefit from their insights into long-term trends.

Those who have held gold since Nixon's $35 valuation and the opening up of personal ownership will be laughing all the way to the vault. Gold demand in what seem like permanently uncertain times has ensured broad rises in the price of gold, but, with fluctuations in the valuation of the precious metal, gold trading can still be lucrative if investors take good advice, make good decisions and, of course, avoid unnecessary transaction costs when they trade.

New developments in gold markets

As financial markets became more sophisticated, even the solid world of commodities saw the introduction of a plethora of new investment instruments.

The gold markets were no exception. Futures, options, derivatives, shares, and exchange traded funds were all introduced to the market as some investors sought to use gold as a vehicle for price speculation rather than ownership and long-term investment.

You can learn more about gold ETFs here, but a key difference between those instruments and what BullionVault offers is that when you buy gold - as opposed to an option on buying gold - you actually own the physical gold. While it is likely to be both safer and easier to trade while in a vault, you can even - should you wish - take delivery of the physical gold you've bought.

Gold ETFs are also managed funds, which attract management fees. So, investors may find that the annual costs for ETFs are higher than BullionVault's low storage fees when owning physical gold.

Trading gold online with BullionVault

The other key 21st century development in gold trading is the ability to buy and sell online. BullionVault customers can trade precious metals online 24/7 anywhere in the world.

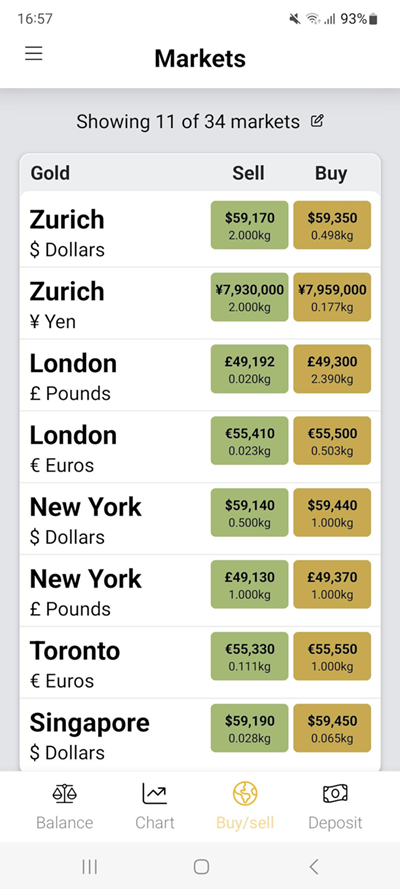

Using BullionVault's app, customers can buy and sell in a selection of major currencies (US dollar, UK Pound, Euro, Yen), and can change the buying and selling currency to optimise exchange rates.

Trading gold online has opened up the market to private investors. With BullionVault, individuals can benefit from the same access to gold trading as a market professional.

BullionVault benefits

BullionVault posts live dealing prices on public internet pages 24 hours a day, seven days a week. You can see the current price of gold in multiple currencies and vault locations on the live order board.

Choose the spread

When you trade gold using BullionVault, you choose whether to post limit prices (earn the spread) or accept other peoples' posted prices (pay the spread - usually about 0.25%).

Currency costs?

BullionVault allows gold trading directly in US Dollars, British Pounds, Euros or Japanese Yen. Users of these currencies incur no currency conversion costs as they deal directly with counterparties trading gold in the same currency.

Dealing larger amounts

BullionVault also allows users to trade whole bars, directly on the professional bullion market. Gold trading of this nature must be conducted during London market hours but there is no limit to the size of trades other than the depth of the professional physical bullion markets, and London is the biggest of the world's physical gold markets.

Types of gold trading

The chemical symbol for gold, is Au, and - fittingly - the market symbol for trading gold on the commodity markets is XAU.

There are a number of ways to trade gold speculatively, but physical gold bars or coins rarely make an appearance. Deals are settled on screens or in cash.

Gold futures

A future is an agreement to buy or sell gold for a set price on an agreed future date.

A standard gold futures contracts represent an agreement to trade the value of 100 troy ounces of gold. Settlement can be made with gold bullion, but almost always it's done for cash, and the profit or loss depends on the difference in the gold price between the date the contract is bought and the date the contract is settled.

Gold futures are traded on the CME derivatives exchange (where they are commonly known as Comex contracts) and the Shanghai Futures Exchange (SHFE). Because they don't require settlement with actual gold bullion, they are not part of the physical OTC (over-the-counter) precious-metals market in London.

Gold options

Gold options give an investor the right to trade gold at a set price (called the "strike price") on the expiry of that option. These are bought in the form of calls (which give the right to buy) and puts (which give the right to sell).

Effectively bets on the price of gold, gold options are backed by gold futures. Call options represent a position that the price of gold will increase, while put options speculate on a decrease in price.

If gold is above the strike price of your put option, for example, the option becomes worthless on the expiry date, but you only lose the premium paid to buy the option - you haven't at any point taken possession of and gold stocks or physical gold.

Gold stocks

Gold stocks are a way of investing in companies that would typically mirror the price of gold. When the price of gold is high, one would expect companies that have involvement in gold mining and exploration to gain in value with positive correlation to the demand for gold.

Gold ETFs

Exchange traded funds (ETFs) are managed fund portfolios that take their underlying value from either physical gold or gold stocks and give broad exposure to the gold market.

Physical gold

Gold bars and gold coins may seen old fashioned in the world of options, futures and funds based on the precious metal, but it still represents a popular investment as a long-term position or as a way of diversifying risk.

Gold can be bought through BullionVault, the world's largest online investment gold service, which takes care of £4 billion in assets for 120,000 customers who can trade silver, platinum, palladium and of course gold 24/7.

Discover more about investing in gold with BullionVault.