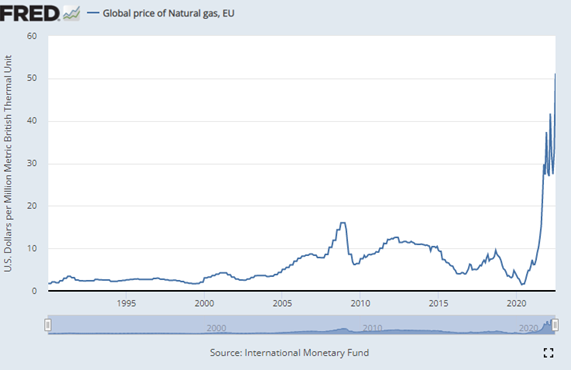

European Gold Prices Rise, Euro Hits 20-year Low Against US Dollar, as Gas Prices Jump on Russian Pipeline Shutdown

GOLD PRICES in US Dollar terms steadied on Monday, while for European investors it rose, amid the Euro hitting a fresh 20-year low as Europe’s energy crisis deepens after Russia keeps key pipeline shut writes, Atsuko Whitehouse at BullionVault.

Spot gold traded sideways at $1711 per ounce, after rallying over $20 last Friday with mixed US jobs data suggested that the Federal Reserve may slow the pace of its interest-rate hikes.

Email us

Email us